Price transparency in healthcare: Progress, barriers and next steps

Consumers want a better view of how much they will owe for care before it’s delivered. That’s where healthcare price transparency efforts come in.

Healthcare price transparency — the ability for consumers to understand how much their care will cost and how much they can expect to pay after insurance has paid its portion — is a top-of-mind concern for consumers. It’s also an area of increased focus for legislators and healthcare organizations.

Yet despite industry acknowledgement that consumers need clear insight into healthcare costs, the road to price transparency still has bumps to navigate.

Where Healthcare Price Transparency Stands

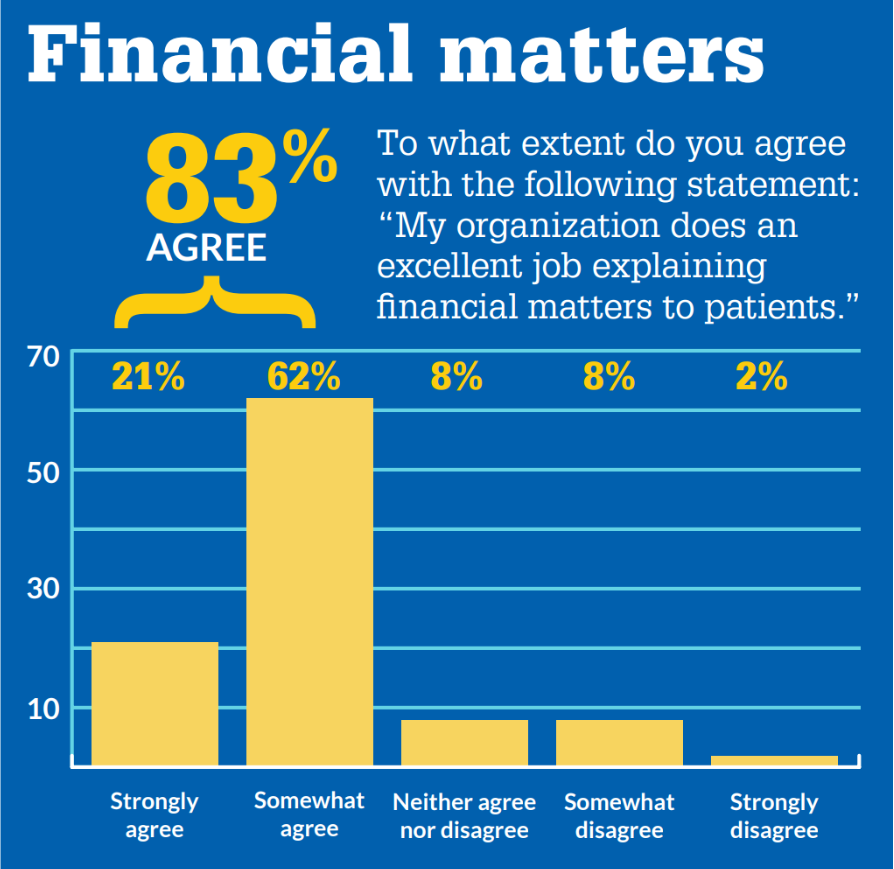

- 83% of healthcare finance leaders believe their organization does a good job of explaining financial matters to patients

- 42% believe their price transparency has improved since 2021

- But while four out of 10 healthcare consumers find their healthcare costs manageable, they can’t afford to pay more

- Three out of 10 healthcare consumers struggle to pay their healthcare costs

- 30 million consumers borrowed money in the past year to pay for healthcare

Government Issues Guidance: A Timeline

The need for improved healthcare price transparency has caught the attention of legislators and federal healthcare agencies.

Here are major moves by the government to put guidelines in effect to strengthen healthcare price transparency:

- January 2021: A final rule requires hospitals to make their prices readily available to consumers for “shoppable services” — care that they can anticipate — or face financial penalties for noncompliance

- January 2021: Health plans and insurance companies must publicly post:

- In-network rates

- Out-of-network allowable amounts

- Billed charges

- Negotiated prices for prescription drugs

- July 2022: Most health plans or insurers posted pricing information for covered items and services, according to the Centers for Medicare & Medicaid Services (CMS)

- July 2023: The Price Transparency Act of 2023 required hospitals to publish the rates they negotiate with health plans for certain services as well as the discounts they offer for cash payments

- 2024: CMS updated healthcare price transparency guidance to make it easier for consumers to find pricing information, such as by requiring hospitals to post a link to their pricing data in the footer of the home page of their website

- May 2025: New guidance requires hospitals to post the actual prices of items and services, not estimates

Price Transparency Impact and Next Steps

Today, employers use price transparency data to make decisions about benefits, while the percentage of consumers who research healthcare providers — including based on cost —before scheduling care is increasing.

But while 40% of consumers say out-of-pocket costs for care are a major factor in determining where to receive care, struggles to obtain pricing data persist. Key barriers to accessing pricing information include:

- Lack of clear data standards

- Incomplete data

- Inconsistent file formats for pricing data

It’s an area where hospitals and health systems must take an active role in establishing best practices for price transparency and financial communications.Find out how leading hospitals are demonstrating the path forward in an HFMA special report, “Curing Payment Confusion”.

Expand Your Knowledge with E-Learning

Stay ahead of industry trends with HFMA’s extensive e-learning courses and webinars.

Advance Your Healthcare Finance Career

Gain the skills you need to meet complex reporting demands with clarity and confidence. HFMA’s expert-designed certifications provide practical, up-to-date training—no matter where you are in your career.

Future of Denials Management Forum

Stay current on guidance for payers and providers on meeting transparency compliance requirements, publishing accurate machine-readable files, ensuring pricing consistency, and preparing for upcoming enforcement trends. Membership is required to access forum.

Healthcare Finance Jobs

Find your next opportunity in healthcare finance.

Discover Trusted Solutions

Elevate your results with products and services recognized by HFMA’s Peer Review program. Explore vetted solutions, each evaluated for quality, technical support, customer service, and value, across these key revenue cycle categories: Billing Compliance/Fraud & Abuse, Coding, Collection & A/R Debt Recovery, Denial Management/Third Party Recovery, Early Out/Self Pay, Patient Access/Eligibility, Patient Accounting/Revenue Cycle Systems, Patient Financial Experience, Patient Financing, and Revenue Cycle Outsourcing.