Community benefit, 340B and Medicare Advantage: Top financial reporting challenges

The complexities of an evolving healthcare regulatory environment demand attention not just from health system leaders, but also for healthcare boards of trustees, employers, community groups and more.

Here are three healthcare challenges likely to capture significant media coverage in the months ahead — and a guide for educating key stakeholders on financial reporting.

Challenge #1: Community Benefit Reporting

State and federal governments are turning up the heat on nonprofit hospitals that receive tax-exempt status.

At issue

Whether these organizations are giving back to their communities through charity care, free screenings, programs that address health-related social needs and more.

What to know

- Hospitals report the level of charity care and other community benefits they provide on the IRS Form 990, Schedule H. This information is publicly available.

- Last year, the IRS announced it would audit 35 nonprofit hospitals, with a focus on community benefit compliance.

- States also are taking a closer look at community benefit:

- 33 states have state charity laws

- 20 states have laws specifying a minimum Federal Poverty Level for charity care

- 11 states have laws offering charity care eligibility for individuals with health insurance

- But while Schedule H provides some insights — like the ability to compare community benefits across similar organizations — it offers a narrow view of the overall benefits provided by hospitals.

- There are also nuances to community benefit reporting that should be considered.

Challenge #2: 340B Drug Pricing Program Transparency

The 340B Drug Pricing Program is a key source of cost savings for participating hospitals, but there are threats to the program from multiple angles.

At issue

Congress is eyeing cuts to the program as a way to cut expenditures. Meanwhile, 37 drug manufacturers have restricted access to 340B pricing since 2020. Today, calls have become louder for transparency around how hospitals apply these savings.

What to know

- The 340B Drug Pricing Program is a federally mandated drug pricing program that requires drug manufacturers to provide drug discounts to certain nonprofit healthcare organizations.

- It’s also a critical source of funding for “safety net” hospitals: those that provide care for organizations regardless of their ability to pay.

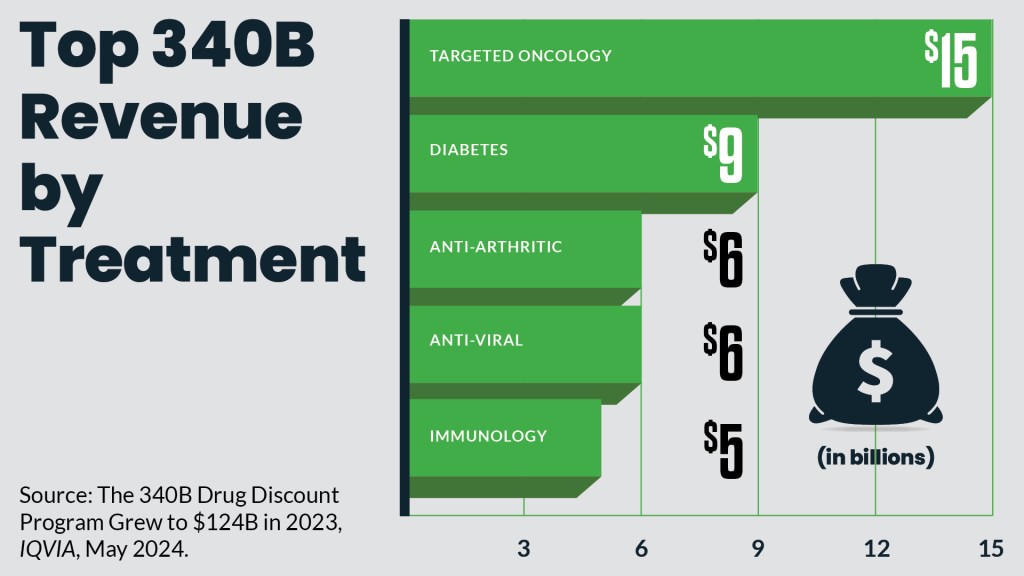

- Patients benefit from these savings, too, including patients with cancer and diabetes.

- Changes to the program could increase drug expenses for hospitals — and ultimately threaten hospitals’ ability to provide care for vulnerable patients.

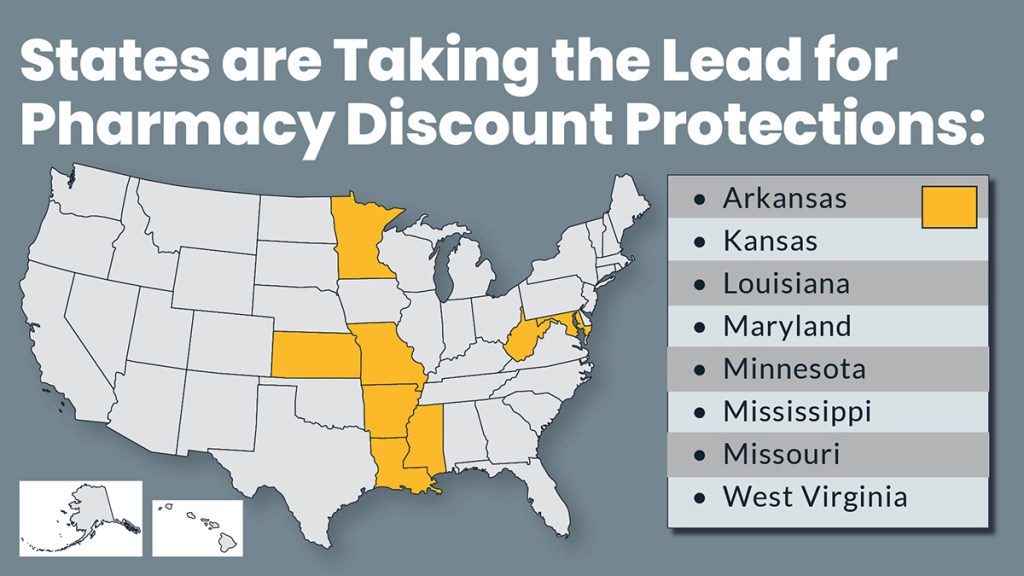

- While federal legislative relief remains uncertain, states have begun to enact legislation to provide contract pharmacy protections for hospitals.

- Health system leaders should understand how to properly assess their system’s 340B savings and demonstrate how these savings are being used to benefit their community.

Challenge #3: Medicare Advantage Financial Statement Reporting

There’s a call for greater transparency around the extent to which commercial insurers who operate Medicare Advantage and Medicaid managed care plans delay or deny care.

At issue

Increased transparency could give lawmakers and government agencies a better view into how often commercial insurers who run these plans delay or deny care.

What to know

- There’s a lack of required consistency around how hospitals disclose the volume of services they provide for Medicare Advantage and Medicaid managed care plans run by commercial payers.

- Because hospitals report this information differently, it is difficult for government agencies to discern the extent to which commercial insurer protocols — including around prior authorization for services — result in payment delays and denials.

- Such challenges have become a growing issue of health systems at a time when:

- But finance leaders have different interpretations of guidance on how Medicare Advantage and Medicaid managed care activity should be disclosed (for example: revenue by major type of payer).

- It’s time for those who prepare hospital financial statements to:

- Revisit their organization’s past disclosure model.

- Look for ways to increase transparency so users of these statements can more easily determine the extent of commercial insurer penetration of these plans.

Developed by the HFMA Principles and Practices Board.

Financial Reporting Resources

Expand Your Knowledge with E-Learning

Stay ahead of industry trends with HFMA’s extensive e-learning courses and webinars.

Advance Your Healthcare Finance Career

Gain the skills you need to meet complex reporting demands with clarity and confidence. HFMA’s expert-designed certifications provide practical, up-to-date training—no matter where you are in your career.

Finance Forum

HFMA Community’s Strategic Finance Forum is where VPs, directors, managers and supporting staff focus on exploring, sharing and solving financial reporting issues.

Healthcare Finance Jobs

Find your next opportunity in healthcare finance.

Discover Trusted Solutions

Elevate your results with products and services recognized by HFMA’s Peer Review program. Explore vetted solutions, each evaluated for quality, technical support, customer service, and value, across these key revenue cycle categories: Billing Compliance/Fraud & Abuse, Coding, Collection & A/R Debt Recovery, Denial Management/Third Party Recovery, Early Out/Self Pay, Patient Access/Eligibility, Patient Accounting/Revenue Cycle Systems, Patient Financial Experience, Patient Financing, and Revenue Cycle Outsourcing.