Four financial challenges EDs face

Both health plans and patients regularly underpay or deny payment for significant portions of the allowed amounts they are obligated to pay.

Various trends and policy changes have combined to increase financial challenges for hospital emergency departments (EDs) in recent years.

A recent report from RAND, “Strategies for Sustaining Emergency Care in the United States,” identified four emerging challenges for EDs with major financial ramifications for hospitals and health systems. Those include:

- Flat-to-declining payment rates

- Increasing Medicaid volumes

- Increasing downcoding by payers

- Increasing costs from waits and boarding

By 2024, ED visit numbers almost reached prepandemic numbers nationally, with a consistent rise between 2020 and 2024, said the report, which was funded by an affiliate of the American College of Emergency Physicians called the Emergency Medicine Policy Institute. It’s a trend that appears to have continued, with year-to-date (YTD) ED visits-per-day 4% higher than a year earlier, according to Kaufman Hall data for February.

Payment cuts

RAND’s analysis of claims data from 2018 to 2022 found that commercial payers’ ED facility fee allowed amounts increased 18.65%. However, almost all of that increase occurred in 2019 and 2020, while rates remained almost flat since 2020. During the same period, average allowed amounts for ED professional fees decreased 7.42% in real terms.

“Payment to physicians per ED visit is falling, placing particular strain on the finances of ED physician practices that operate independently of hospital or health system ownership,” wrote the report’s authors.

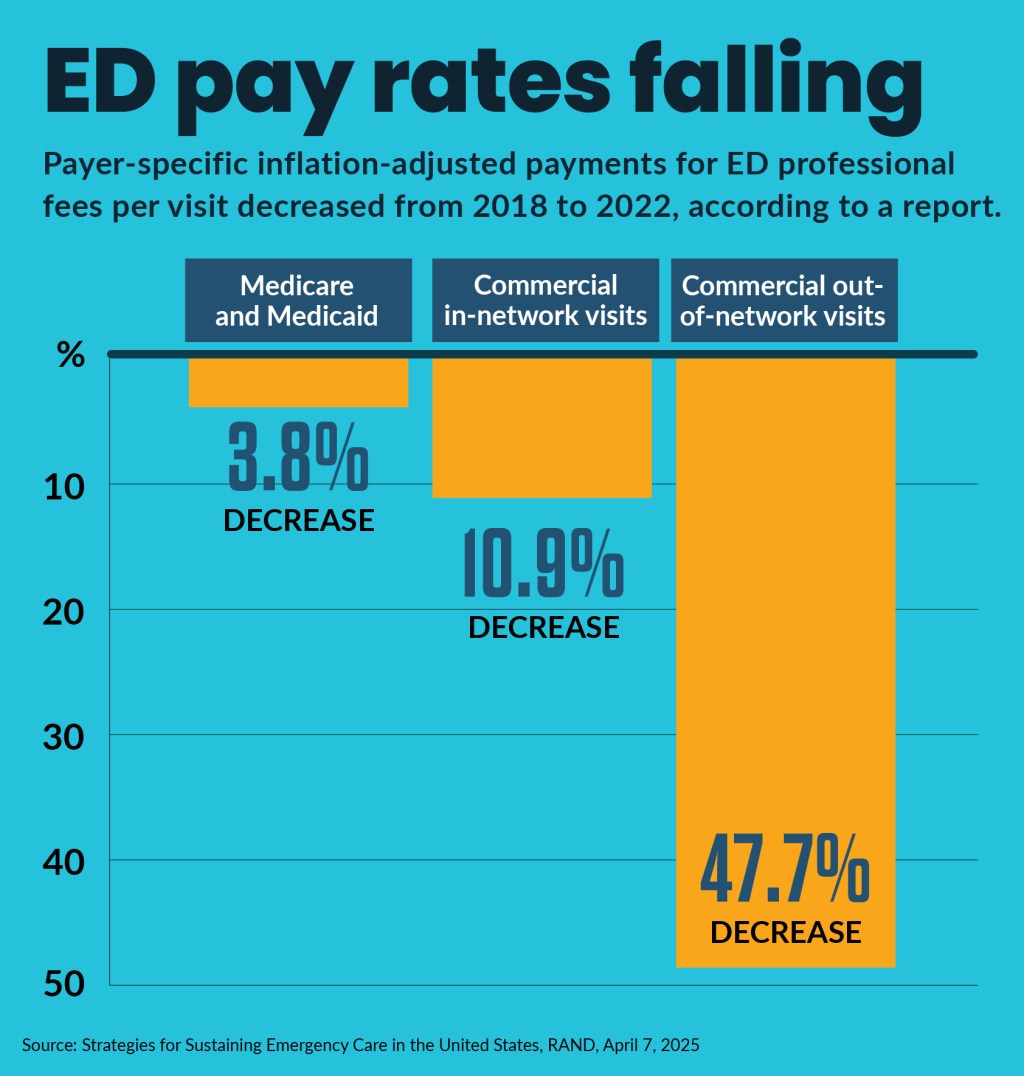

Payer-specific inflation-adjusted payment changes per ED visit, from 2018 to 2022, included:

- 3.8% decreases for Medicare and Medicaid

- 10.9% decrease for commercial in-network visits

- 47.7% decrease for commercial out-of-network visits

“These real drops in payment resulted from falling commercial prices, low payment rates (failure to fully pay the agreed-upon prices, including nonpayment or denial of payment), and inflation,” wrote the report’s authors.

Based on data from revenue cycle management companies, the report found that both health plans and patients regularly underpay or deny payment for significant portions of the allowed amounts they are obligated to pay.

Uncompensated care

The report found uncompensated and undercompensated ED care has increased and resulted in nonpayment of 20% of expected payment to ED physicians across all payer types, or about $5.9 billion annually.

A factor driving uncompensated care increases is growing ED use by Medicaid enrollees. The report cited several recent studies that found that in some Medicaid expansion states ED utilization increased. For instance, a 2022 study found in Medicaid expansion states” the ED payer mix among pre-Medicare-age adults in Medicaid was 35.5% compared with 24.8% in control group states (where no expansion took place).

The share of ED visits by the uninsured in expansion states was 19.2% versus 30.9% for the control group states. Among private payers the ED patient mix was 45.2% compared with 44.4% for the control group.

States with the largest increase in Medicaid enrollment experienced an increase in ED visits.

From 2011 and 2021, Medicaid ED visits as a share of all payers increased to 45% from 34%, according to an analysis of the National Hospital Ambulatory Medical Care Survey. In California, 2019 Medicaid visits accounted for nearly 42% ED visits, despite Medicaid covering only 25.1% of the state’s population, according to another study.

“Because Medicaid beneficiaries account for such a significant share of ED visits, low payment rates are concerning for the sustainability of emergency care,” said the RAND report.

Payer policies

The report also identified an increase in payer down-coding—in which a health care service claim is changed to a lower care level by the payer, resulting in a lower payment. Related adverse effects on ED revenue were seen from payment denials and the negative financial impacts of the No Surprises Act (NSA).

ED leaders interviewed in the report expressed concern that the NSA gives insurers too much influence to exert downward pressure on commercial payments for emergency care. Although the report’s authors concluded it wiil take more time to fully quantify the NSA’s financial impact, they said early adverse effects were seen in their findings of a steep decrease in professional fees paid for commercial out-of-network care from 2018 to 2022.

Beyond health plans’ administrative obstacles to payment, ED finances also are affected by the nationwide shift in commercial insurance toward high-deductible health plans, which leaves commercially patients to pay directly for many ED costs.

Research has pointed to the wide variation in charges across EDs for the same level of service, which affects both uninsured and insured patients. One study showed that charges for a level 4 visit across EDs in California ranged from $275 to $6,662.

“Taken together, this research highlighting the rising portion of allowed amounts that patients are responsible for and the rising, high costs of providing care for ED patients has caused challenges for advocates aiming to increase payment for ED services in line with costs,” said the report.

ED boarding

The report highlighted the cost challenge from increased boarding in EDs, which occurs when a patient is admitted to inpatient status but is then treated in the ED instead of in an inpatient bed because of a lack of available inpatient beds.

Although ED boarding is a long-standing issue, evidence suggests that the COVID-19 pandemic may have exacerbated the problem. For instance, an analysis of ED data showed that length of stay increased for ED patients, (182 minutes in 2019 versus 211 minutes in 2022), as has the rate of individuals leaving without being seen.

Other research found ED boarding was more costly to hospitals than moving patients to an inpatient bed or admission holding unit.

“The authors surmise that there are opportunity costs and revenue losses for the ED with boarding because bed limitations prohibit new patients from being seen or accepted for transfer to EDs from other facilities,” said the report.