Hospitals treating more patients with fewer staff

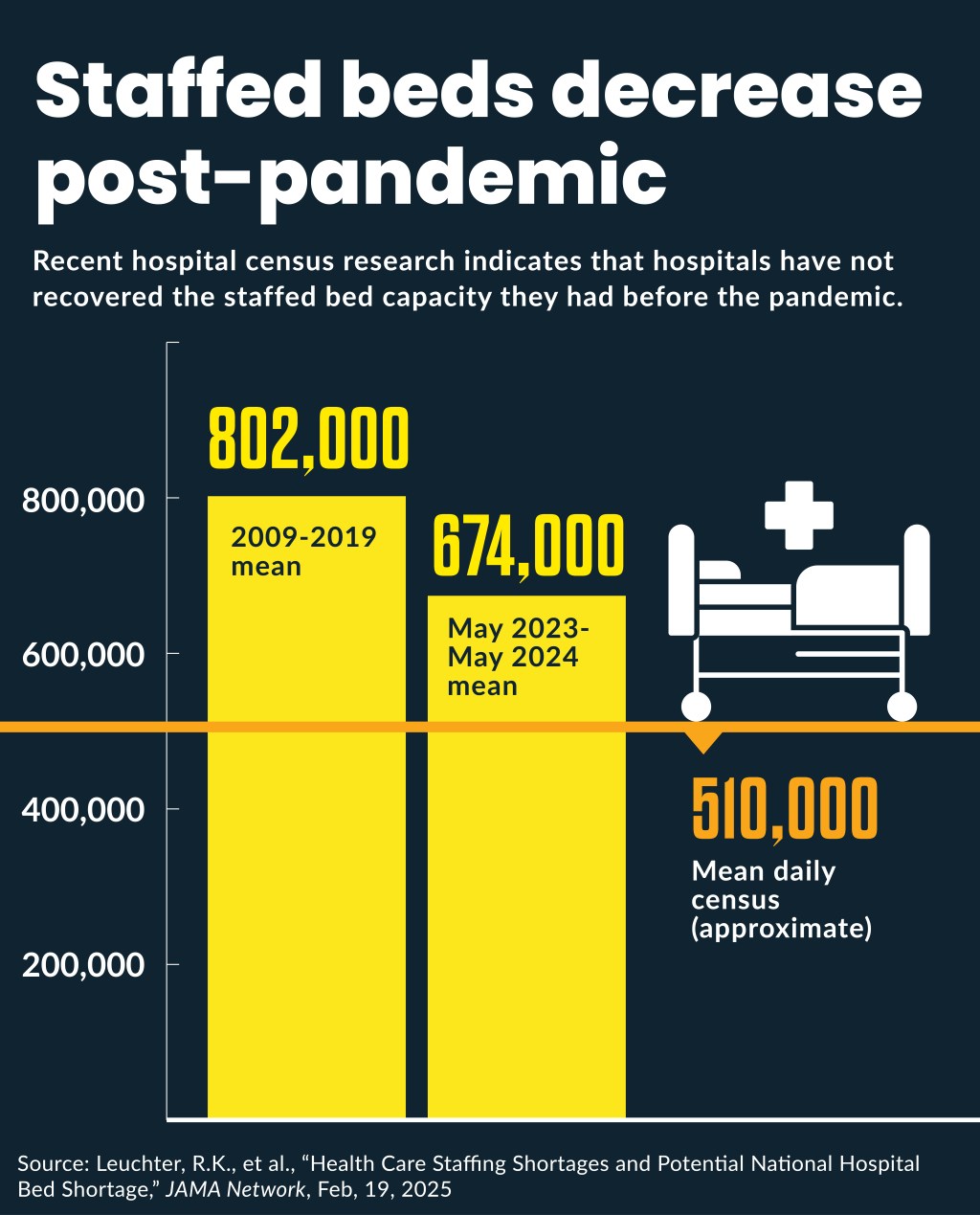

Mean staffed beds have decreased by 16% from the pre-pandemic period.

Although patient volumes have surpassed pre-pandemic levels, data indicate hospitals are caring for them with fewer staff.

From 2009 to 2019, hospitals had a mean 802,000 staffed beds, according to research published in February in JAMA. However, from May 2023 to April 2024, the mean staffed beds decreased 16% to 674,000. Meanwhile the mean daily census decreased by less than 1% between the two periods.

It was starkly different change than identified through American Hospital Association (AHA) member surveys, which found less than a 2% decrease in staffed beds from 2019 to 2024.

Unlike the voluntary AHA data, the post-pandemic JAMA data was mandated from hospitals by HHS and tracked by the Centers for Disease Control and Prevention as a federal COVID response.

Tracking hospital staffed beds is notoriously complicated for private firms because hospitals define staffed beds, licensed beds and available beds in very different ways, said Erik Swanson, a senior vice president leading Kaufman Hall’s Data and Analytics Group.

Since 2022, Kaufman Hall data (which comes from Strata Decision Technology) has found a 9% decrease in hospital full-time employees per average occupied beds, which is its closest corollary to staffed beds.

“That may mean you have fewer staffed beds,” Swanson said. However, that Kaufman Hall metric also includes the non-caregiving staff, such as shared services and back-office staff.

“By in large, with the clients we work with, most would indicate broadly that they are more efficient or have fewer staff per volumes that they are seeing, then pre-pandemic,” Swanson said.

Some for-profit health systems have reported something similar to investors. For instance, HCA Healthcare executives noted their salaries, wages and benefits (SWB) have fallen to their lowest share of expenses since the company last went public in 2011, even as their occupancy has surged to 77% in the latest quarter, up from 75% in the same quarter in 2024.

“We run pretty much a fixed cost business and so if you can keep your fixed costs fixed and get volume growth, we can leverage that synergy and produce operating leverage for the company,” said Mike Marks, CFO of HCA.

That system’s increased occupancy echoed the industry-wide increase in occupancy from 63.9% pre-pandemic to 75.3% in the year following the end of the COVID-19 public health emergency (May 2023 to April 2024), according to the JAMA study.

Tumultuous times

The apparent increase in hospital labor efficiency followed tumultuous labor changes during the pandemic. It started with hospitals slashing jobs in March 2020 as the pandemic set in and hospitals did not return to that number of positions until November 2022, according to data from U.S. Bureau of Labor Statistics.

But labor costs remained inflated during the pandemic because health systems surged their use of contract labor, especially for nurses, to make up for staff shortages. Then hospitals sought to cut contract labor costs by rehiring employed nurses and by 2024 most health systems reported their contract labor costs had returned to pre-pandemic levels.

Another complication came during hospital efforts to restore their employed staff, especially clinical staff. As they were increasing hiring to replace contract labor, a historic jump in inflation occurred from 2022 to 2024, which made new employees more expensive.

Those factors may have encouraged health systems to look for more labor productivity, even as patient volumes surged since 2022.

“We also know that the volumes themselves are up,” Swanson said. “They actually could be at the same number of staff that they had pre-pandemic but relative to greater volumes of patient coming through are running more efficiently or with fewer staff.”

Kaufman Hall data found a 9% increase in hospital discharges per calendar day by March compared to the same period in 2022.

Swanson said hospitals have been focusing on ways to minimize occurrences of both over-staffing and understaffing as patient volumes fluctuate.

“You can hit your ratios with fewer people but be more aligned to demand,” Swanson said. “So, it ultimately ends up being a triple win. That’s certainly been a mindset that we have seen.”

Wide variations in hospitals’ post-pandemic staff also are affected by either health systems’ internal staffing standards or government mandates on staffing ratios.

Three states have minimum nurse-to-patient staffing ratios and several others require staffing committees, public reporting or some combination of the two, according to tracking by Chartis.

Additionally, some hospitals have reduced staff by eliminating financially unsustainable services.

“For certain clinical services, organizations have also had to make tough decisions,” Swanson said. “‘Are these service lines or services that we want to or can continue to provide? Or do we not have the volumes, or is the cost of recruiting in providers and others prohibitively high?’ Those are certainly being questions asked.”

Labor shift

Another recent trend has been hospitals hiring more staff not directly related to staffing beds, said Danny Schmidt, healthcare senior industry analyst for RSM US, a consulting firm.

“It’s probably a different type of individual they’re hiring in the different areas,” Schmidt said about the divergence between overall hiring and staffed beds.

Many hospitals and health systems have pushed to ensure clinical staff are used to the full extent of their license. Some have invested in adding lower-level clinical staff to take non-traditional roles. That can include partnering with colleges to bring in students without higher credentialing.

For instance, HCA augments its more than 100,000 employed nurses with nearly 20,000 nursing students from its quickly growing Galen College of Nursing, as well as those from other nursing schools, who do rotations and practicums at its hospitals. HCA plans to have nearly 30,000 nursing students in Galen schools by the end of the decade.

Other hiring trends have focused on value-based care, in which clinicians provide preventative care instead of acute care. That includes the use of remote nurses and care coordinators serving patients outside the hospital, such as those being managed post-discharge and in hospital-at-home programs.

“While they are caring for people, [the patients] may not be in the hospital,” Schmidt said.