Bad debt, charity up 32% since 2022

Bad debt and charity care as a percent of gross revenue increased 2% over the period.

Uncompensated care costs sharply accelerated in recent years, but they were mostly offset by increasing hospital incomes, according to recent data.

Together, bad debt and charity care per calendar day increased 32% year-to-date (YTD) 2025 compared to YTD 2022, according to Kaufman Hall’s latest hospital flash report, which uses data from Strata Decision Technology.

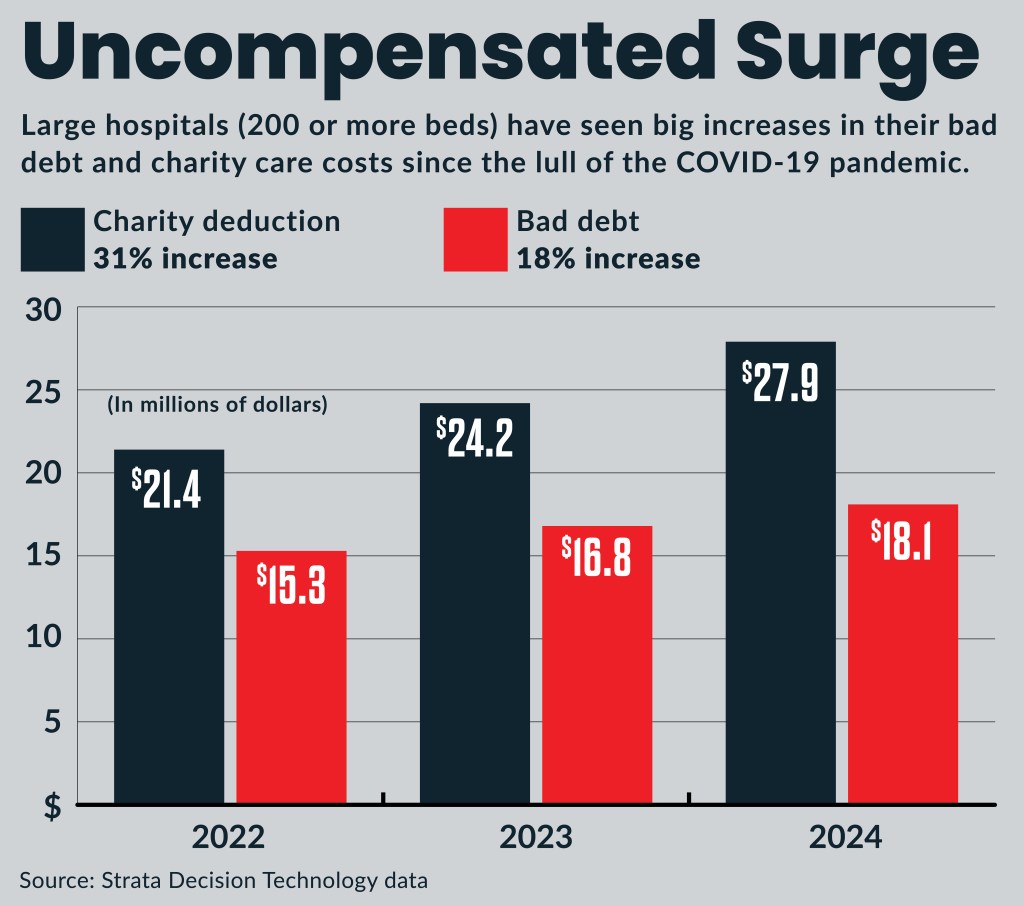

It’s a surge also seen in other data. For instance, full year charity deductions for large hospitals (more than 200 beds) increased 31% from 2022 to 2024 and bad debt increased 18% in the same time period, according to Strata data exclusively provided to FastFinance.

Erik Swanson, managing director for Kaufman Hall, noted that the big increase in bad debt charity care came amid a 31% increase in gross operating revenue per calendar day, over the same time period. Both uncompensated care and revenue are surging from lows during the COVID-19 pandemic.

“Much of this due to the increases in volume that we have seen over that period, as well as [payment] rates rising for hospitals,” Swanson said.

However, bad debt and charity care as a percent of gross revenue also increased 2% over that period. That indicates uncompensated care is growing faster than revenue.

“This is a longer-term trend that we’re seeing,” Swanson said about the trend that pre-dates the COVID-19 pandemic.

What’s behind it

The factors driving uncompensated care up for hospitals include:

- Increased payer denials

- Increasing hospital patient acuity

The denials trend is in turn driven by multiple factors, including increased payer use of AI tools.

“There may be areas there where the initial denial rates are going up and if they are not ultimately adjudicated with the hospital and brought through a robust revenue cycle process, it may be that hospitals are simply missing that,” Swanson said.

Hospitals have responded to those drivers through a variety of measures, including an increasing use of AI tools in the revenue cycle process. Additionally, hospitals and health systems have pursued adding terms and conditions during their contract negotiations with payers that limit some first-pass denials or establishing processes to adjudicate those claims.

The patient acuity trend, Swanson said, is driven by the growing number outpatient options for low acuity care. That has left hospitals and especially emergency departments [EDs] to handle a growing share of the higher acuity patients, who are unable to get care in lower acuity settings.

“And if the patients aren’t able to access those other ambulatory sites, part of the reason may be that they are uninsured or underinsured, so the ED becomes their last resort,” Swanson said.

That patient trend also was seen in the 13% increase in ED visits per calendar day that Kaufman Hall data found in the same 2022 to 2025 time period.

EDs part in the trend

Although it is not shown in the publicly released data, Kaufman Hall’s data has found EDs have had an increasing share of uninsured and underinsured patients in recent years, Swanson said. That is an ongoing trend that emerged before the COVID-19 pandemic.

The hospital trend has continued despite uninsured rates reaching historically low levels.

“Even with decreasing uninsured rates, your hospitals and EDs will be bearing the uninsured population, even while there may be greater volumes going through the primary care, urgent care center or other sites of care,” Swanson said.

Over the last 15 years, the share of commercially insured patients with large out-of-pocket costs — especially high deductibles — have made them the largest group of underinsured. Those with employer-sponsored insurance were 66% of all underinsured identified by Commonwealth Fund research.

The trend of insured patients, when they need lower-acuity, less costly care with out-of-pocket costs they can afford, shifting out of EDs to ambulatory settings has, in turn, driven disruptor investment in such ambulatory settings in recent years, he said.

Other emerging ED challenges, according to a recent analysis, include:

- Flat-to-declining payment rates

- Increasing Medicaid volumes

- Increasing downcoding by payers

- Increasing costs from waits and boarding