The Healthcare CFO of the Future: Turning risk into opportunity

The role of the healthcare CFO is evolving — and so are the skills needed for success. Here, CFOs and industry experts explore the new competencies CFOs must possess and how leaders in this space are preparing for the future.

With support from:

From his office in Cleveland, three wide computer screens sit on Bradley Bond’s desk, providing a real-time pulse on the latest investment markets activity and delivering breaking news in the world of finance.

“I watch the capital markets like a hawk,” said Bond, CFO for University Hospitals (UH) and former vice president of treasury for the health system.

Under his leadership, UH has issued more than $5 billion in taxable and tax-exempt public bonds and negotiated more than $2 billion in notional swap transactions and more than $2 billion in bank credit facilities.

“We have a big swap derivative portfolio and $3 billion in investments, so that’s still near and dear to my heart,” Bond said.

He keeps tabs on currency markets and political moves that could affect financial performance, such as tariffs on imports, not only because of the implications for the health system’s investment portfolio, but also because it helps in risk management of the system.

The industry has changed and is evolving at a faster pace than ever before, and with it, the CFO’s role is changing, too.

The evolution of the CFO role isn’t a new concept — its transition from a bean counter role into a senior leader with heavy involvement in strategy and business planning has been well-documented over the past 30 years.

But the rate of change into that new role has not, and the pace of the transition has never been greater, Bond said.

“I think we have to be innovative in finance,” he said.

Likewise, CFOs must also be skilled in risk management to navigate today’s complex environment.

A hard job getting more difficult

There are two areas where today’s CFOs need to become increasingly well-versed: moving toward value-based care and addressing the consumer experience.

Ninety percent of healthcare CFOs agree somewhat or strongly that new healthcare CFOs face a more challenging road to success than CFOs did in the past when they took on the role, according to a survey of 116 industry CFOs conducted by HFMA for this report.

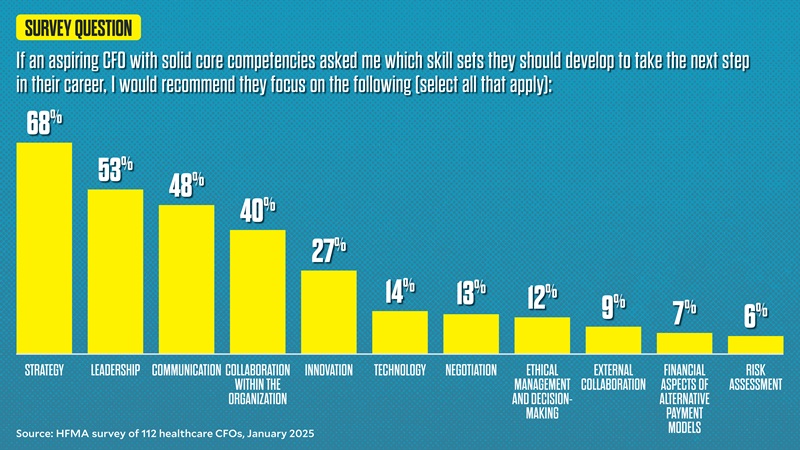

Strategy is considered the most important skill set for aspiring CFOs to develop, two out of three respondents said, followed by leadership (52.7%), communication (48.2%) and collaboration (40.2%).

“There is clearly momentum building around broadening the definition of the CFO across industries, given some of the headwinds and tailwinds we’re seeing, and I think healthcare, especially, is going to be at the forefront of reimagining the role of CFO,” said Ashraf Shehata, principal and U.S. sector leader for healthcare at KPMG.

Interestingly, although health system leaders at the J.P. Morgan Healthcare Conference in January declared that healthcare must find an ROI from AI, just 14.3% of healthcare CFOs responding to the HFMA survey believe technology ranks as the top skill set aspiring CFOs should develop.

An end to budgeting in isolation

Guidehouse Partner David Burik envisions the most successful CFOs as being those who reclaim the budgeting process by shifting away from “budgeting in isolation” toward a more collaborative process that enables a more detailed understanding of the organization’s needs and opportunities.

“I think pretty consistently CFOs had principal leadership for the balance sheet,” Burik said. “The capital structure was theirs. The investment strategy was theirs. M&A went through them. And then from the income statement perspective, they were responsible for revenue cycle. They were the Great Oz when it came to managed care negotiations. So we had this very powerful set of diverse activities for which the average CFO was pretty much depended upon in their organization.

“We believe the most successful CFOs will be revisiting a longstanding portion of their portfolio — the budget — and will be working to make the budgeting process more collaborative, taking advantage of all the money they’ve spent on IT,” Burik said.

They also will be working with administration to retrain people with budget responsibility as to what those responsibilities are and how they can construct the budget and make suggestions for their budget so there’s budget integrity and it’s a team activity, Burik said.

As healthcare CFOs navigate a rapidly changing environment marked by increased financial pressures, more intense focus on achieving AI maturity, the need to more effectively manage risks related to value-based care and more, CFOs are taking varied approaches to preparing for the future.

What most people don’t understand about the role of the healthcare CFO:

“Just how truly complex it is. It’s unlike [the CFO role in] any other industry in that it’s very difficult to know you are making good decisions today given the complexity [of the industry] and all the ways that things can go wrong.”

HFMA CFO survey respondent

What CFOs really want

Niyum Gandhi, CFO and treasurer of the not-for-profit health system Mass General Brigham, based in Boston, has seen a shift in the types of conversations healthcare CFOs have with each other during industry gatherings.

“If you look back at the CFOs from the 1990s and the early 2000s, the CFOs who started at large health systems around that time were these brilliant financial wizards,” Gandhi said. “They brought financial controls, which the industry needed. They knew how to embed financial discipline into the business. Even five, seven years ago, the conversations were more operationally strategic: ‘How do I move length of stay? How do I keep labor costs down?’ Now, it’s much more about, ‘How do I diversify revenue? How do I think about the shape of the organization in the future?’ It’s less defense and more offense.”

Value-based care, payment and contracting is an area where CFOs need to become more up to speed if they are to assist in achieving the granular results expected, said Stephen Forney, CFO of Covenant Health in Andover, Mass., a not-for-profit, regional health system.

“I don’t think, in a broad sense, that healthcare CFOs are really prepared for or attuned for understanding what value-based care is, how it is going to get implemented in their context and their type of organization, the principles of value-based care and how you drive ROI around it,” he said.

Unless CFOs are prepared for value-based care, during conversations with clinical operations, when the CFO is “calling the balls and strikes around ROI,” Forney said, “that can get out of control really quickly.”

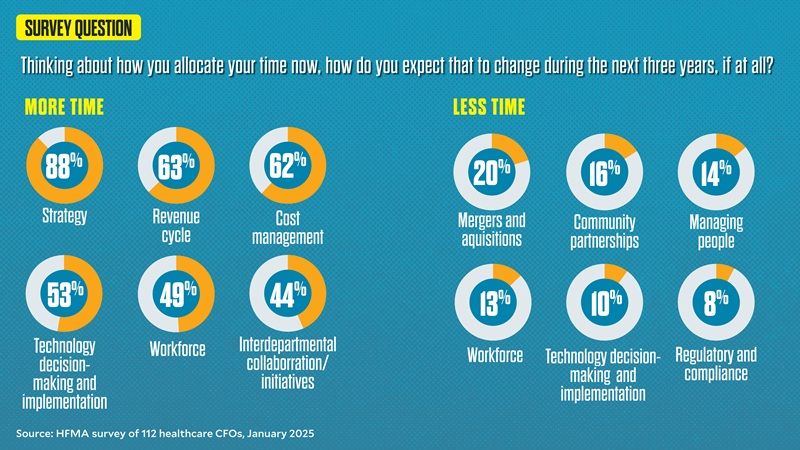

Survey results show that 88% of CFO survey respondents expect to spend more time on strategy in the next three years. Other areas of increased focus include revenue cycle (63%) and cost management (62%).

For UH, part of the health system’s value strategy involves viewing payers more as partners than as adversaries in looking for value-based efficiencies that can benefit all parties.

“We need to get paid for value,” Bond said. “And that’s the evolutionary part of the CFO role, figuring out how to get paid, and not just paid, but paid fairly,” he added.

“If we’re taking downside risk, we’re providing a huge benefit to the payer in that we’re taking volatility out of their earnings per share, and we’re providing them a benefit. What’s that value worth? That’s the key.”

Bond said the CFO role has to get a lot more sophisticated in the drive toward value.

“What I hear about a lot is, ‘Oh, well, you can share 50-50 in the upside and 50-50 in the downside,’” he said. “That is very perfunctory, in my mind. You have to look at the risk you’re laying off, and you have to really get sophisticated in pricing networks, much like a hedge fund would or a private equity manager would.”

Laurie Beyer, CFO of Greater Baltimore Medical Center, said her organization is evaluating whether it needs to create an executive role for value because the journey toward value-based care and contracting is so complex.

Even more than the pressure to achieve and sustain financial success, CFOs surveyed by HFMA said they anticipate their greatest source of stress over the next three years will be positioning the organization for success through a period of rapid change in a macro environment (42%).

“Healthcare finance is extremely complicated as well as under-resourced in many areas,” one CFO survey respondent said. “Every year, I personally find it more difficult to achieve work-life balance. There are always burning platform issues.”

Rural issues

The rural healthcare sector faces its own challenges in maintaining strategic decision-making in healthcare. With 46% of hospitals operating with negative margins and 428 rural hospitals tagged as being vulnerable to closure, taking strategic steps to protect the rural healthcare safety net requires a higher skill set for rural health leaders than it did in the past, one CFO survey respondent shared.a

“Prior to COVID, the lack of business acumen in senior leadership — mainly in rural, nonprofit hospitals — could be covered up by efficiencies in other areas,” the survey respondent said. “Now, that is not the case. We must demand that senior leaders in today’s healthcare environment have a higher level of skills than they did in the past or we will continue to see these rural hospitals struggle. Stop putting nurses and doctors that have zero business background in charge of these health systems.”

Consumerism continues to carry weight

The need to create more consumer-centric care experiences and models for access, care delivery and payment is a top-of-mind concern for CFOs interviewed. It’s an area where the type of preparation CFOs most recommend for aspiring CFOs — developing emotional intelligence, coalition building and/or communication skills (61%) — could come into play. Just one out of three chose “earning a graduate degree such as an MBA.” The demand for softer skills among CFOs is strong.

“We can disappoint pretty profoundly in healthcare,” said Dennis Dahlen, CFO, Mayo Clinic. “The way we can make some progress around the consumer experience is by making sure we’re not disappointing customers.”

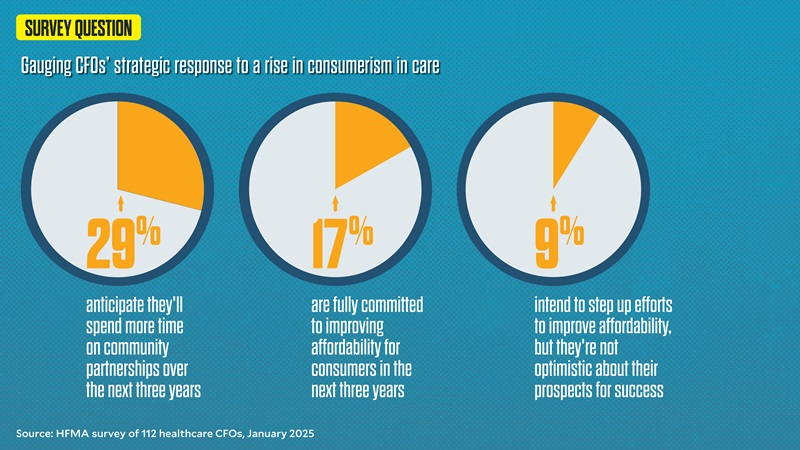

However, the results have been mixed when survey respondents try to elevate the consumer experience in healthcare.

For instance, when it comes to addressing consumers’ frustration with the affordability of care, just 17% said they are fully committed to improving affordability over the next three years. Instead, there’s an overwhelming sense among respondents that consumers will continue to be frustrated with healthcare affordability unless major changes are made at the national and state healthcare policy levels.

And when asked how they anticipate they’ll allocate their time over the next three years, just 29% anticipate they’ll spend more time on community partnerships. More than half (55.6%) envision they will spend the same amount of time on community partnerships as they do now.

A CFO in action

At Jackson County Regional Health Center in Maquoketa, Iowa, strengthening consumer visibility into costs of care is a strategic area of focus. CFO Kolin Huth said the organization is undertaking a price transparency project that involves looking at healthcare prices within a 50-mile radius, making sure its prices aren’t too high or low. For critical access hospitals, “financial sustainability comes down to dollars and cents,” he said. The information ultimately will be posted on the organization’s website and in specialty clinic areas so patients have accurate information to make informed decisions.

“With our system being located between two metro areas, we want to make sure we’re not only in compliance with price transparency requirements, but also that we’re maintaining a competitive advantage for those services,” Huth said.

Building a better consumer experience must go beyond simply trying to provide a more retail-like experience, Forney believes. Otherwise, leaders will struggle to achieve substantial change in consumers’ perceptions of their hospital or system over the long term.

“You can’t compare yourself to Apple,” Forney said. “I want to go buy my new Apple watch. I don’t want to go to the hospital. So it’s really about understanding how you can improve that customer experience, knowing that the customer doesn’t want to be there. It’s defining the experience your organization wants to provide rather than exploring ways to entice consumers to come to your facility.”

Gandhi of Mass General Brigham recommends aspiring finance leaders and current CFOs spend time watching care in action and talking with people who need treatment to better understand where an organization can strengthen relationships with the communities it serves.

“Spend time watching care be delivered,” he said. “Spend time in research labs, seeing drugs being discovered. Whatever it is, be closer to care. We will make better decisions for consumers and make their lives better.”

Regularly telling the hospital or health system’s value story to the community is also essential — and it’s an area where CFOs can make a significant contribution.

“Communication is the trusted currency,” said Richard Gundling, FHFMA, senior vice president, healthcare financial practices, HFMA. “Patients trust us with their lives, so we have to meet them there.”

Sharpening the CFO’s data view

As CFO, Alfred Lumsdaine’s responsibilities have encompassed a broader set of strategic and operational responsibilities to align with the overall mission of Nashville-based Ardent Health. Strengthening expertise in data analytics and technology has become critical.

“Our industry, like most, is increasingly data driven, and the CFO [and their] teams have to have the ability to analyze and interpret large volumes of data for decisions to help drive decision-making,” Lumsdaine said.

As economic pressures, changing consumer behaviors and changes in healthcare policy both increase risk and affect risk tolerance, CFOs need to use data to help inform what will happen, not what has happened, he said.

It’s an area where a CFO’s understanding of emerging technologies, like AI, and ability to apply these technologies to decision-making is becoming even more critical.

For instance, at a time when payers are overwhelmingly using AI to deny claims for services, with initial denial rates hitting 11.8% in 2024, a health system’s own prowess in leveraging AI and data analytics to both combat denials and build better relationships with payers will be an essential tool for financial sustainability.b

A focus on payer-provider relations

Nearly three out of four CFOs surveyed by HFMA say building better payer-provider relations is one of their top priorities over the next three years or that they have delegated this responsibility to team members and expect significant improvements.

Following the murder of UnitedHealthcare CEO Brian Thompson and a public response that reflected deep consumer discontent with the U.S. healthcare system, CFOs are especially sensitive to the expectation that leaders establish better relationships with health plans. They see that doing so will ultimately improve the consumer experience. But many aren’t sure where to start. And 17% of CFOs surveyed believe “the zero-sum environment between payers and providers usually precludes meaningful partnerships.”

“It’s in payers’ economic interest to delay care,” said Mayo Clinic CFO Dennis Dahlen. “It’s in providers’ economic interest to treat patients as soon as possible, as rigorously as necessary. Unfortunately, until we resolve that misalignment, this is an area where we’ll continue to struggle.”

He believes what is needed, in part, is agreement around arms-length transactions, where a set of generally accepted conditions for immediate care are accepted by health systems and health plans, eliminating the need for prior authorization in those instances.

At Greater Baltimore Medical Center, which operates an oncology services center, Beyer’s team used data analytics to review reimbursement for the most used 20 drugs.

“We found out there were three drugs that we were getting reimbursed for less than our cost,” Beyer said. “We put a proposal together, starting with our largest commercial payer, with a template that outlined, ‘This is what we do for your patients. These are the awards we’ve won,’ just putting the story together. Since then, we’ve done the same thing with three other large commercial payers.” The response to the payer outreach has been positive, Beyer said.

“Things have gotten a lot better,” Beyer said. “We’re a low-cost, high-quality provider. We have a great reputation, and my director of contracting, she’s been around for 20-plus years, and she’s developed these relationships. It’s critical to have good people in that area.”

Skill in using data analytics to tell an organization’s value story also distinguishes providers in a competitive marketplace. One way CFOs can contribute to the organization’s value story is by sharing data around metrics that matter to consumers, from information around out-of-pocket costs to data related to the impact of community benefit or quality-of-care initiatives, Ardent Health’s Lumsdaine said.

At OSF Healthcare in Peoria, Ill., a major contributor to margin sustainability is what leaders call “the automation imperative” — it’s an initiative leaders believe will better position the organization to continue to meet its mission.

“We’ve set a target for ourselves of a $200 million positive impact to the health system’s financials over a 10-year time period through automation, including through the use of AI,” said CFO Kirsten Largent. “So far, we have documented over $50 million in savings, either in releasing capacity from a productivity standpoint or in actual green-dollar savings.”

Going beyond managing the day-to-day

Among CFOs surveyed by HFMA, some believe that the industry is reaching a breaking point. “We — CFOs and HFMA — need to be leading the way to a solution,” one respondent said.

Now is the time for CFOs to evaluate their circumstances and skill sets and develop a road map for leading a transformation.

“We are in an industry that is changing quickly on multiple dimensions,” Lumsdaine said. “The consumer experience, payment structures — those can change overnight. I think CFOs are uniquely positioned to lead their organizations through complex change by focusing on communication, management and continuous improvement. That is and will be a critical component of the CFO role.”

Footnotes

a. Topchik, M., et al., “2025 rural health state of the state: Instability continues to threaten rural health safety net,” Chartis, 2025.

b. Press release, Kodiak Solutions, Feb. 27, 2025.