Hospital employment sees 8.3% increase since pre-pandemic high

Healthcare jobs have outpaced non-healthcare industries for 31 consecutive months.

Hospital employment has increased 8.3%, or 434,000 new positions, since the pre-pandemic high it reached in February 2020, according to an industry tracker.

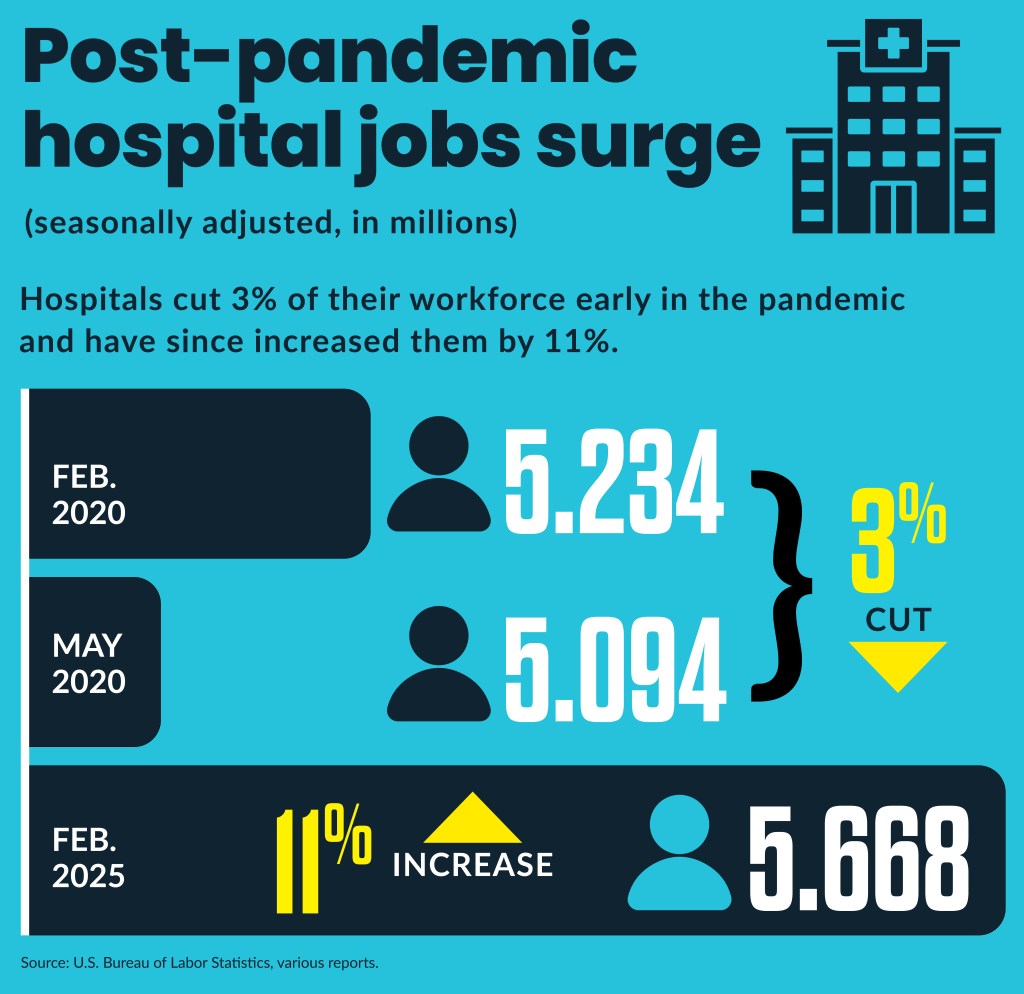

The recovery followed hospitals sharply slashing jobs in the early months of the COVID-19 pandemic as patients were told to avoid hospitals and their revenue dried up. They reached their low point of 5.094 million jobs in May 2020, or a 3% reduction, from their February 2020 peak, according to the Bureau of Labor statistics (BLS).

The February 2025 hospital employment of 5.662 million staff is an 11% increase from their pandemic lows.

“These trends align with the consolidation we are seeing in recent years, with hospitals, health systems, and other health care providers aligning to form larger, more sophisticated health care delivery models with more of a business focus on ambulatory health care services,” said Joe Wolfe, an attorney for Hall Render. “This trend has been accelerating in recent years and largely relies on the development of an employed and aligned work force with appropriate supporting infrastructure. An aligned work force can facilitate enhanced care coordination and quality among different parts of the employed health care delivery model, leading to better care and improved patient outcomes.”

The latest data on hospital jobs comes amid a reorganization at the Department of Health and Human Services that will cut 20,000 out of 87,000 positions, including 300 at CMS. The reductions include 10,000 voluntary departures.

Post-pandemic surge

The recovery in hospital jobs mirrored, to different extents, the employment recovery across much of healthcare, an Altarum analysis found.

Altarum findings on healthcare job gains since February 2020 include:

- 14%, or 1,115,000 job, in ambulatory health care services

- 8.3% or 434,000 jobs, in hospitals

- 0.6%, or 19,500 jobs, in nursing and residential care

“At the same time, we are also seeing a shift in health care towards outpatient settings, driven by technology, shifts in reimbursement and cost-effectiveness,” Wolfe said. “Many procedures and treatments that were once exclusively performed in hospitals can now be safely and effectively managed in outpatient settings, leading to increased access and convenience for patients. Outpatient settings may be better suited for providing preventative care, early detection of diseases, and management of chronic conditions.”

Altarum found that since February 2020 overall healthcare employment increased by 1,569,000 jobs, or 9.5%, which was more than double the 3.9% increase in non-health care employment.

Other findings include:

- Healthcare job creation rate quickened in February 2022

- Non-healthcare employment growth began to slow in April 2022

- Healthcare jobs have outpaced non-healthcare industries for 31 consecutive months

Latest employment results

In February 2025, the healthcare industry added 52,000 new jobs, which was close to the monthly average of 54,500 jobs added in the previous twelve months. The February additions compared to only 99,000 jobs added in all non-healthcare sectors.

Individual healthcare segment new jobs included:

- 14,900 in hospitals

- 25,600 in ambulatory healthcare services

- 10,800 in physician offices

- 4,100 in home healthcare services

- 3,900 in outpatient care centers

- 11,500 in nursing and residential care facilities

Over the last year, healthcare-wide job openings, hiring rates and job departures have been generally stable. Changes from January 2024 to January 2025 include:

- Job openings decreased from 7.2% to 4.2%

- Hiring rate decreased from 4% to 3.3%

- Quits decreased from 2.8% to 2%

Year-over-year nominal wage growth was highest for hospitals. Healthcare segment one-year wage growth included:

- 4.6% for hospitals

- 4.5% for ambulatory services

- 3.7% for nursing and residential care facilities

Hospital view

Health system leaders said they have seen their employment situation stabilize over the last year.

HCA Healthcare tracks its labor stability by the extent of contract labor it uses. At the height of the pandemic, almost 10% of HCA’s salaries, wages and benefits (SWB) costs were consumed by contract labor. By the end of 2024, contract labor took about 4.55% of SWB.

“First it reflects that the market itself has stabilized — the overall supply and demand of labor,” Mike Marks, CFO of HCA, said at a March 20 investor conference. “Number two, it’s a reflection of the hard work that the company has worked on for the last several years on workforce development.”

HCA has emphasized improving retention through various initiatives, which have brought turnover down to pre-pandemic levels.

To increase the pipeline of staff, especially nurses, HCA works with nursing and allied clinician schools in their markets “to help them do placements, to help them do rotations and to be a great employer as their students graduate,” Marks said.

The system also sees payoffs from its investment in the Galen School of Nursing, including increasing its student capacity, as well as helping to train and employ its graduates.

For 2024, Community Health Systems (CHS) saw its labor costs increase by about 4% of net revenue, which was a slower increase than in 2023. It could slow to 3.5% in 2025 but remains elevated from its historical 2.5% rate.

“We’re making very good progress in terms of our recruiting, nurse turnover,” Kevin Hammons, CFO or CHS, said at a March healthcare investor conference. The system specifically has had good results from its centralization of its recruiting functions. Additionally, the health system’s use of contract labor has returned to near its pre-pandemic level.