Medicaid work requirements gain support in polls, but cuts to federal funding have mixed reactions

Polls indicate public views on Medicaid changes are highly malleable to arguments both in support and against them.

Congressional Republican’s proposal to require able-bodied Medicaid enrollees to work, volunteer or get job training drew support from majorities in recent polls.

Other Republican proposals to reduce federal Medicaid had more mixed reactions from the public.

Recent public polling from KFF and Paragon on work requirements found:

- 62% support requiring nearly all adults to work or look for work to get Medicaid

- 84% support able-bodied adults to work, volunteer or get education to get Medicaid

The different results could stem, in part, from the varying political leanings of those surveyed. For example, the KFF survey polled 15% more Democrats than Republicans, while Paragon sampled 4% more Republican voters.

The recent surveys echoed a 2023 Axios-Ipsos survey that found 61% supported work requirements for Medicaid enrollees, while 35% opposed such requirements.

Why it matters

Congressional Republicans have advanced a budget that would cut about $2 trillion in federal spending over the next 10 years. As much as $880 billion could come out of the projected $1.6 trillion increase in Medicaid spending over the next 10 years.

The specific approaches Congress will use to derive savings from Medicaid will be decided by the Energy and Commerce (E&C) Committee, which has primary jurisdiction over Medicaid.

It’s uncertain what approaches the E&C committee will use but some congressional Republicans have advocated mandates that able-bodied adults — a majority of Medicaid enrollees — have requirements to work, obtain education or volunteer in order to receive Medicaid coverage.

Medicaid work requirements “is on the list of things that will probably happen,” Brian Blase, PhD., president of Paragon, said in an interview.

Previous estimates of the Congressional Budget Office (CBO) is $109 billion in 10-year savings from national Medicaid requirements to work, get training or volunteer.

2023 HHS data said 89% of non-elderly adult Medicaid enrollees worked full time.

Respondents to the Paragon survey said the federal government should set Medicaid work requirements (54%) versus a state deciding on work requirements (46%).

One work requirement option examined by CBO led it to conclude that about 2.2 million adults would lose Medicaid coverage. CBO did not project whether those leaving Medicaid would get other coverage, such as through an employer or the ACA marketplaces, as happened during the recent Medicaid redeterminations.

Other cuts

Other potential cuts to Medicaid that Congress is considering could come from reducing the amount of provider taxes that hospitals pay to fund the state share of the program dually funded by states and the federal government.

Federal law allows state to apply differentiated Medicaid taxes by provider type, (e.g. different rates paid by hospitals versus health centers) of up to 6% of a provider’s net revenues from treating patients. Ten-year savings from reducing those range from $48 billion to $248 billion, while eliminating them would save $630 billion, CBO estimated.

Among the two recent surveys, only Paragon asked respondents about the use of provider taxes and found:

- 57% agreed the taxes are “just another way that states take advantage of federal taxpayers to cushion their budgets and cater to health care special interests.”

- 43% agreed the taxes are “a reasonable way to make sure that states and their health care systems have enough money to care for their people.”

The Paragon survey also dove into Medicaid supplemental payments, which a CMS rule change in 2024 allowed states to use to increase Medicaid rates as high as average commercial rates. The survey asked respondents about “The government paying hospitals and other health care providers two to three times more for treating Medicaid patients than they do for Medicare patients” and found:

- 30% support

- 70% opposed

Federal match

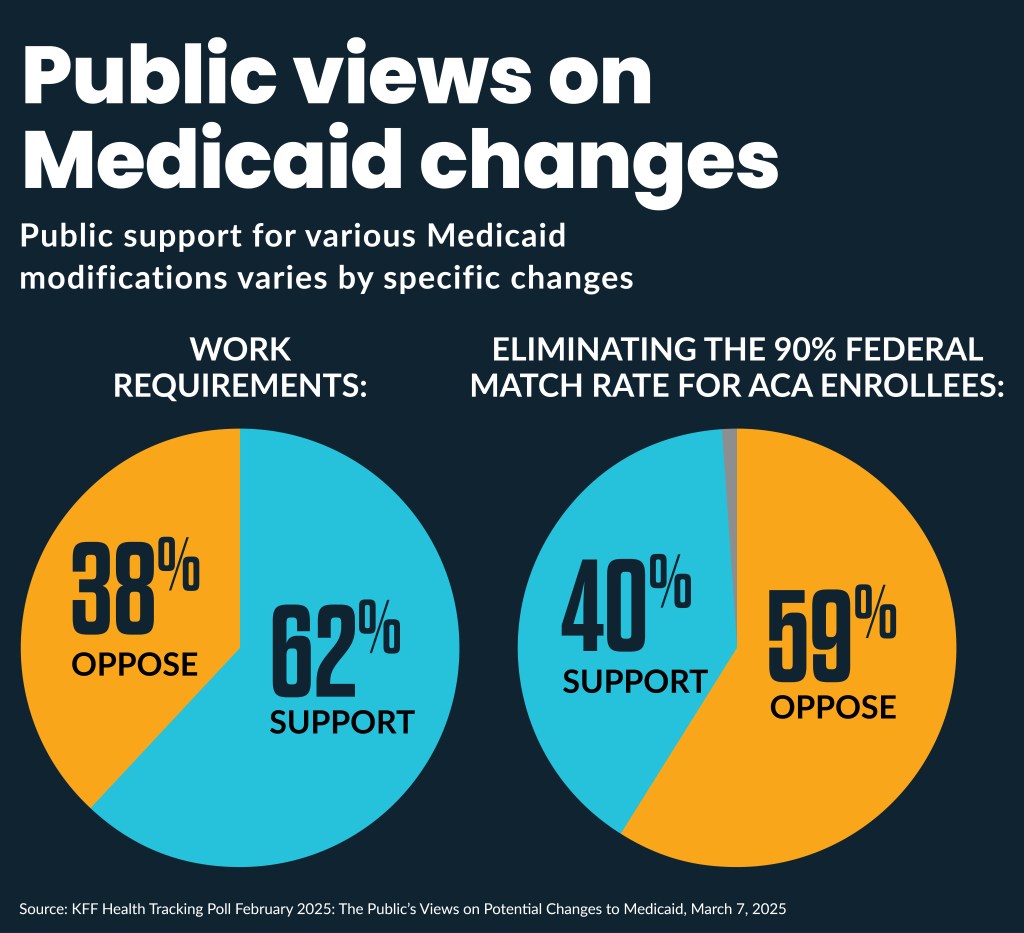

Another Republican proposal would reduce the 90% federal match for enrollees eligible through the ACA to the match for non-ACA enrollees. Paragon findings included:

- 58% supported reducing the ACA enrollee match to the rate for traditional enrollees

- 42% opposed lowering the ACA enrollee match

KFF found reducing the 90% federal match for ACA Medicaid enrollees was “somewhat malleable when more information is presented.”

When supporters of the proposal hear that most states wouldn’t be able to make up the funding and that 20 million people would likely become uninsured as a result, support dropped from 40% to 24%, KFF found. Conversely, when opponents of the proposal heard it would reduce federal spending by $600 billion over ten years, support increased from 40% to 49%.

Reducing the match for ACA enrollees would save the federal government $596 billion over 10 years, according to CBO projections.

The KFF poll was conducted Feb. 18-25, online and by telephone among a nationally representative sample of 1,322 U.S. adults. The Paragon poll, conducted by Public Opinion Strategies, surveyed a representative set of 1,000 registered voters from across the country Feb. 25 to March 2.