Medicaid cuts could lead to material negative impact on healthcare providers

Fitch was less concerned about the Trump administration’s push on tariffs adversely affecting health systems and hospitals.

Proposed Medicaid cuts under consideration in Congress could be “materially negative” for providers, a debt rating service said in a recent note.

“Meanwhile, potential major changes to Medicaid that may result from the FY2025 budget process are a bigger risk than three months ago and could be materially negative for healthcare providers depending on the form …” said a Feb. 28 update from Fitch Ratings.

Fitch analysts wrote that downside risk to Medicaid reimbursement has increased following the budget resolution passed by the House of Representatives on Feb. 25.

“If Congress ultimately uses budget reconciliation to extend the 2017 tax cuts, they will need to identify major expenditures to offset, such as Medicaid, to meet the budget neutral requirement,” Fitch wrote.

Fitch noted that Medicaid specifics were not included in the resolution passed in late February.

“The ultimate impact on credit profiles will depend on whether there are absolute reductions in Medicaid spending that are not offset by states (the most impactful), on to whether there are reductions in future growth rates and on to whether there are changes in implementation (such as work requirements or culling of fraudulent expenditures), with these being the least impactful to credit profiles,” said Fitch.

The rating agency noted that a significant reduction in federal funding for Medicaid “would be a material credit negative for healthcare providers, especially those that have benefitted in recent years from new or expanded Medicaid supplemental payment programs.”

Hospital officials have warned that the federal reductions in Medicaid spending may end up increasing costs in other areas.

“You take away Medicaid and you end up with bed debt and charity or sicker patients because they are delaying care,” said Kimberly Hodgkinson, former CFO of Hospital Sisters Health System. “I’m not sure they always think about the ins and outs of decisions.”

Congressional action

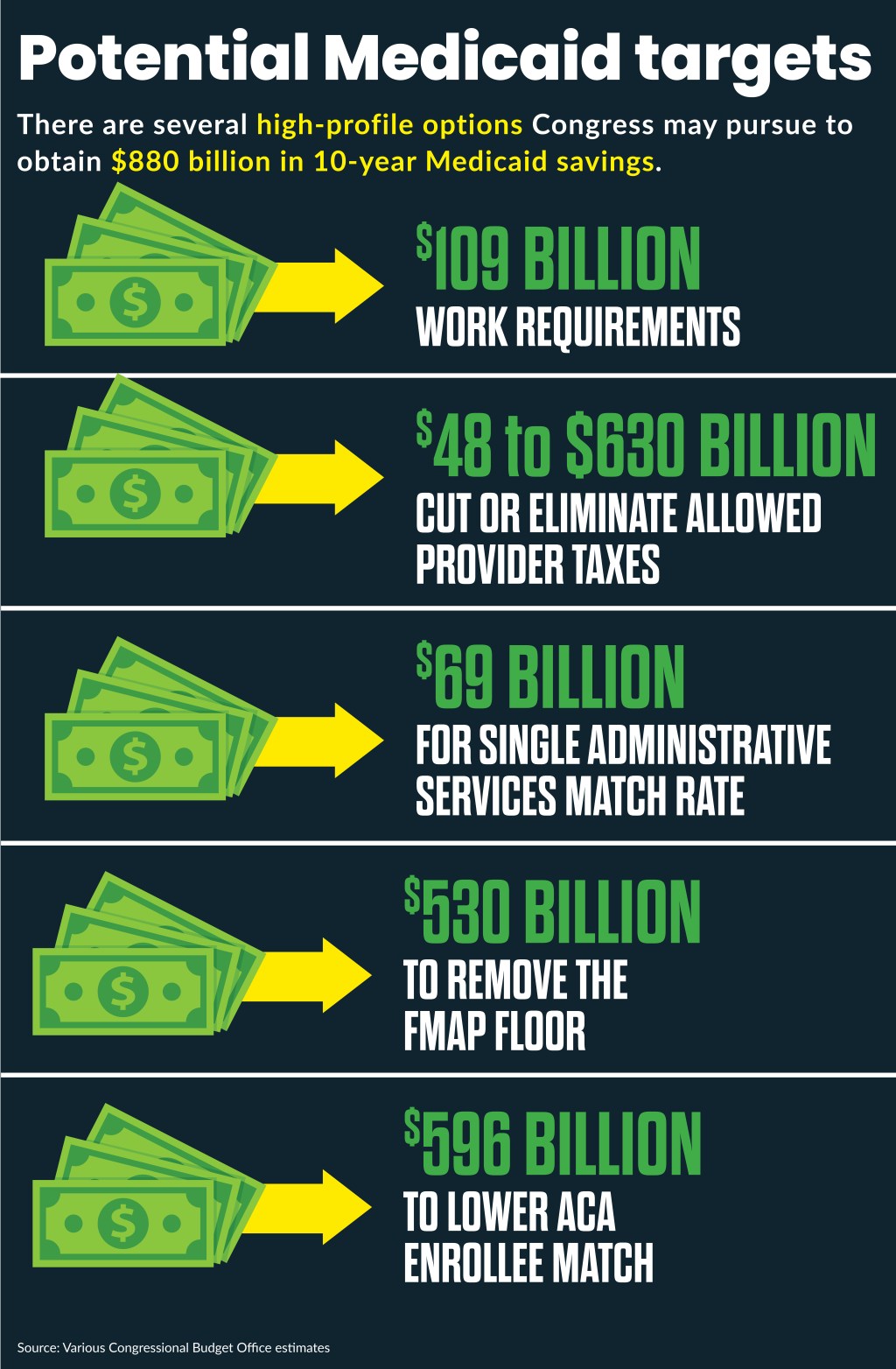

Congressional Republicans have advanced a budget that would cut about $2 trillion in federal spending over the next 10 years. As much as $880 billion could come out of the projected $1.6 trillion increase in Medicaid spending over the next 10 years.

“Downside risk to Medicaid reimbursement has increased following the budget resolution passed by the House of Representatives on Feb. 25,” Fitch wrote.

The specific approaches Congress will use to derive savings from Medicaid will be decided by the Energy and Commerce (E&C) Committee, which has primary jurisdiction over Medicaid.

It’s uncertain what approaches the E&C committee will use but some congressional Republicans have advocated mandates that able-bodied adults — a majority of Medicaid enrollees — have requirements, to work, obtain education or volunteer in order to receive Medicaid coverage.

Medicaid advocates cite a March KFF analysis of the Current Population Survey ASEC Supplement of Medicaid non-disabled adults that found:

- 44% working full time

- 20% working part time

- 12% not working due to caregiving

- 10% not working due to illness or injury

- 8% not working due to retirement, inability to find work or another reason

- 7% not working because of school attendance

Previous estimates of the Congressional Budget Office (CBO) is $109 billion in 10-year savings from national Medicaid requirements to work, get training or volunteer.

“For Medicaid payers, incorporation of work requirements would likely be a direct, moderate revenue headwind due to reduced enrollment,” Fitch wrote. “Increased levels of uncompensated hospital care would also have an indirect impact on insurers in that hospitals could seek higher payment rates for privately insured patients to offset higher uncompensated care costs.”

Other potential cuts to Medicaid could come from reducing the amount of provider taxes that they use to fund the state share of the program dually funded by states and the federal government.

Federal law allows states to apply differentiated Medicaid taxes by provider type, (e.g. different rates paid by hospitals versus health centers) of up to 6% of a provider’s net revenues from treating patients. Ten-year savings from reducing those range from $48 billion to $248 billion, while eliminating them would save $630 billion, CBO estimated.

Critics of provider taxes said they are just a way for hospitals to pull down significant federal funds since the federal funds they receive are more than twice what they pay.

“We over-subsidize Medicaid, we’re over-subsidizing states, and we’re allowing them to money-launder essentially to inflate federal costs,” said Brian Blase, president of the Paragon Institute — a conservative think tank — and a former Trump adviser.

Conservatives also have urged reducing the federal matching rate for Medicaid in a variety of ways. One would use the same matching rate for all categories of administrative services; another would remove the 50% minimum for federal matching, called the FMAP; and another would reduce the 90% federal match for enrollees eligible through the ACA to the match for other enrollees.

CBO’s 10-year projected savings for such changes include:

- $69 billion for one administrative services match rate

- $530 billion to remove the FMAP floor

- $596 billion to lower ACA enrollee match

“If the federal match for Medicaid funding to NYS is reduced and that burden shifts back to the state government, there’s no money in Albany to cover that,” said Adam Anolik, CFO of Rochester Medical Center. “So, things like that could be significant dollars to us.”

Tariff warnings

Fitch was less concerned about the Trump administration’s push on tariffs adversely affecting health systems and hospitals.

In early March, Trump implemented tariffs on Mexico, Canada, and China, although he later suspended some and expanded other product-specific tariffs.

“Tariffs will have a moderately negative impact on the credit profiles of pharmaceuticals and medical devices, diagnostics and products issuers, while posing a lower risk to healthcare providers given their domestic focus,” Fitch wrote. “We believe most companies’ supply chains and credit profiles can withstand the impact of tariffs against China, Canada and Mexico, especially for innovative products with pricing power, but the impact would be more difficult to offset if there are major changes to trade relations with Europe as that may portend few markets will, eventually, be unaffected.”