Medicaid proponents weigh in as potentially big cuts come under consideration on Capitol Hill

The House soon might pass a budget resolution that would set the stage for Medicaid dollar reductions of well into the hundreds of billions over 10 years.

Feb. 26 update: In a vote on the evening of Feb. 25, the House passed the budget resolution. Specifics of the spending cuts will now be drafted by the respective House committees, and the House and Senate will then have to agree on the final bill.

Supporters of healthcare providers and consumers are growing increasingly wary of the prospect that big Medicaid cuts will happen in the FY25 budget reconciliation process.

Advocacy is picking up as work to pass a budget for the remainder of the fiscal year accelerates ahead of the March 14 expiration of federal funding.

President Donald Trump boosted the efforts of House Republicans to push through a budget that would include a tax-cut extension with a price tag of at least $4.5 trillion and also would raise the debt limit. On Feb. 19, Trump said he preferred to see the House budget move forward, whereas Senate Republicans subsequently passed a smaller budget resolution focused on defense, energy and immigration policy initiatives.

Within the House bill’s $2 trillion target for spending cuts, $880 billion is due to come from the healthcare policy-focused Energy and Commerce Committee. Medicaid is believed to be front and center on the list of programs to trim.

Trump recently reiterated that he wants the spending cuts to leave Medicaid unscathed, but other statements from the administration have indicated that perceived fraud, waste and abuse in the program will be fair game.

Analysts foresee the possibility of policy changes in Medicare as well, such as through an expansion of site-neutral payment or a requirement for off-campus outpatient departments to obtain their own national provider identifier for billing purposes. Reforms to pharmacy benefit managers also are on the table.

More details are expected to be forthcoming the week of Feb. 24, when the House returns from a week-long recess with tentative plans to vote on the budget resolution.

Sounding the alarm

America’s Essential Hospitals (AEH) is among the advocates that have been increasingly vocalizing their support for Medicaid. AEH sent a letter to the bipartisan leadership of the Energy and Commerce Committee, protesting the possibility of big cuts to the program.

Among the budgetary options that the association hopes will be avoided are cuts to state-directed supplementary payments. AEH said the payments are vital to help cover a Medicaid shortfall that totaled $10.4 billion among safety-net hospitals in 2022.

AEH also hopes Congress will eschew substantial changes such as slashing the federal medical assistance percentage (FMAP) for the Medicaid expansion population and instituting per capita funding caps for states.

There’s also speculation that Congress will allow a scheduled three-year, $24 billion cut to Medicaid disproportionate share hospital (DSH) payments to take effect. The cut has been repeatedly delayed and modified since being included in the Affordable Care Act.

Other potential policies that are drawing concern include establishing work requirements for Medicaid beneficiaries and rescinding Biden administration regulations intended to expedite enrollment.

Although work requirements would be a less sweeping change than per capita caps or FMAP reductions, one expert said the impact should not be taken lightly. For example, Arkansas received a waiver to implement work requirements during Trump’s first term, and 18,000 residents lost coverage in the 10 months before a federal judge halted the policy.

“It’s not uncommon for a Medicaid policy to have unintended consequences around administrative withdrawals or administrative cessation of coverage for a lot of beneficiaries,” said Jennifer Evans, healthcare compliance chair with Polsinelli and formerly deputy director with the Colorado Department of Healthcare Policy and Financing. “We saw that with the wind-down of the public health emergency, and we also saw that with work requirements in the one state.”

A high-impact reduction

While Congress has projected about $100 billion in 10-year savings from instituting work requirements, $561 billion could accrue if the federal government reduced the FMAP for the expansion population to match the traditional Medicaid population. Such a change would drop that portion of the FMAP from 90% to less than 60% in many states.

Feb. 24 correction: The first figure in the paragraph above was updated from $100 million to $100 billion.

A dozen states have “trigger” laws that require them to terminate the Medicaid expansion either immediately or after a review if the expansion-segment FMAP is curtailed. For states with more leeway, responses could entail restricting eligibility or provider reimbursement.

“States are going to have to make decisions about cutting provider rates,” Evans said. “They can cut some services, but states aren’t permitted to cut all Medicaid services — they have some mandatory services. It’s really much easier from an administrative perspective to simply cut provider rates.

“What happens when you cut provider rates? You see fewer Medicaid providers enrolled in the system altogether, you see diminished access to care, [diminished] availability of Medicaid providers to serve the remaining beneficiaries. And ultimately in some communities, you see exit of certain healthcare providers who have a large Medicaid population.”

Stating the case

The possibility of such consequences spurred a coalition of Medicaid advocates to voice their concerns. The group Caring Across Generations hosted a media call Feb. 20 in which roughly a dozen healthcare stakeholders expressed why Medicaid is too crucial to cut.

“Even if you aren’t on Medicaid now or in the future, a massive cut to Medicaid would certainly impact the hospitals, clinics and the whole health system in your area,” said Anthony Wright, executive director of Families USA.

Those who see judicious Medicaid cuts as sound policy say the program runs well below optimal efficiency.

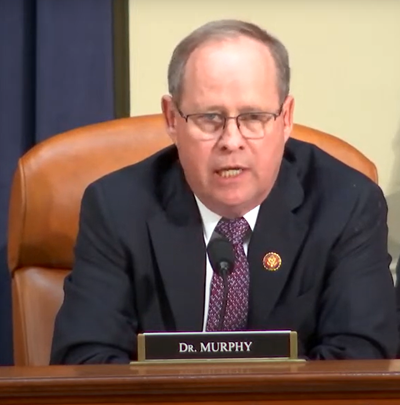

“When I see a 35-year-old guy that’s on Medicaid the rest of his life because he has a little back pain — I see the waste, fraud, and abuse every day, and it’s OK to come in and reset and look at things,” Rep. Greg Murphy (R-N.C.), a urologist, said during a February hearing of the House Ways and Means Committee’s Health Subcommittee.

The Government Accountability Office (GAO) includes Medicare and Medicaid on its list of high-risk areas, indicating the programs are especially susceptible to fraud, waste and abuse. In FY23, the programs combined for more than $101 billion in improper payments, representing 43% of such payments across the government.

Other areas of concern that spurred the GAO’s high-risk designation for Medicaid included state-directed supplemental payments, due to a lack of federal oversight.

“Cutting things is not the way that you create more flexibility or that you find fraud and abuse,” said Nicole Jorwic, chief of advocacy and campaigns with Caring Across Generations. “If you’re cutting even $100 billion via a work-reporting requirement, that’s going to impact oversight of the program, that’s going to impact program integrity, that’s going to impact access to services.”