Rural healthcare providers see improving financial outlook, but challenges persist

Only 12% saw any likelihood of entering an M&A over the next few years.

Some rural providers are increasingly optimistic about their financial future and much less likely to consider mergers and acquisitions (M&A), according to a new poll.

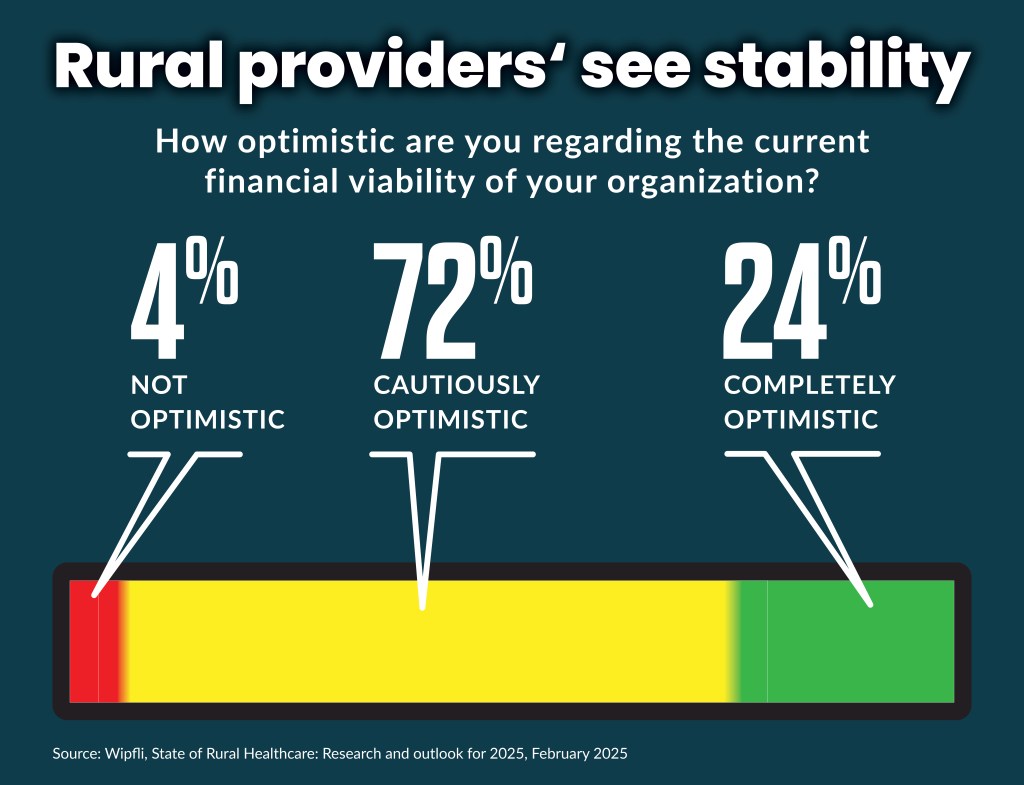

Ninety-six percent of rural healthcare organizations — primarily critical access hospitals (CAHs) — are optimistic about their organization’s financial viability, according to an ongoing survey from Wipfli. That share was an increase from 84% in 2023 and 91% in 2024.

“It’s widely known that rural hospitals are on the margin, so their definition of stability and financial stability is much, much different than, say, a bigger urban hospital,” said Kelly Arduino, the leader for healthcare at Wipfli, an advisory and accounting firm.

Additionally, 58% of respondents this year said their organization was more stable now than it was five years ago, before the COVID-19 pandemic.

The increasing financial stability likely stems from measures taken by rural hospitals to control costs, such as reducing their labor costs. Those costs surged in the immediate aftermath of the pandemic after 100,000 nurses left the workforce, according to one study.

“For the labor force, I’m not saying it’s good, but the disruption has stabilized there,” Arduino said. “They are managing to it.”

On the revenue side, rural hospitals have increased their focus on their contracts from commercial payers, which have long been a minority share of their payer mix.

They started “pulling out their contract and were really digging into their costs and providing information to insurers on what the new cost structure is and … the increases in their contract weren’t really helping them cover their costs,” Arduino said.

Part of that effort was an increased use of tools and assistance to better understand their costs for various services.

The leading educational or training need identified by hospital executives in the survey was for optimizing reimbursement/revenue cycle, which 65% of participants selected.

The national trend

There have been 152 rural hospital closures or conversions since 2010, according to tracking by the Sheps Center at the University of North Carolina. CAH closures or conversions comprised 51, or 34%, of the total. Additionally, 700 more rural hospitals — one-third of all rural hospitals — are at risk of closing because of the “serious financial problems,” according to a report by the Center for Healthcare Quality and Payment Reform (CHQPR).

The poll results may skew more positively than CAH sentiment nationally, Arduino said, because it focused on CAHs in states with higher Medicaid spending.

“You don’t hear CAHs in say Tennessee or Kentucky or West Virginia with the same level of optimism,” Arduino said.

In 2021, Medicaid spending per enrollee ranged from $3,563 in Tennessee to $12,008 in the District of Columbia, according to KFF tracking.

But such higher spending doesn’t always solve rural hospital’s financial problems. For instance, New York has one of the highest spending rates per enrollee — $9,688 — but still has 27 rural hospitals, or more than half of their total, at risk for closing.

Some states also provide more assistance, like $300 million in interest-free loans California provided to rural, independent hospitals in 2023. Still, 23 rural hospitals in California, or 40%, were at risk of closing, according to CHQPR.

“Particularly in the state of California, if it wasn’t for that [support] these hospitals would have been in a much more dire situation.” Arduino said.

In the future, more state and local funding may be needed to bolster the finances of rural hospitals, she said. Several publicly owned rural hospitals in recent years have activated their existing local taxing authority to obtain that funding.

M&A

On their M&A outlook, 78% of respondents said their organization was not likely at all to merge or consolidate within the next two to three years. Only 12% said there was any likelihood of an M&A.

Anu Singh, a managing director at Kaufman Hall, recently said M&A trends in recent years have shifted away from health systems acquiring rural distressed hospitals toward those buyers looking at increasingly distressed urban and suburban hospitals.

“We’re seeing organization in urban, suburban markets with a larger revenue base go down that path of having to do something,” Singh said.

Arduino said it represents a shift from regional hospitals acquiring rural hospitals to the regional hospitals, themselves, getting acquired due to their own challenges.

“I haven’t seen much appetite for acquisition of rural entities,” she said.

Pain points

The positive outlook by respondents to the Wipflisurvey did not come without major forward-looking concerns. Those included:

- 41% said the most significant challenge remained financial concerns or reimbursements

- 31% said managed care/prior authorizations/denials was a major concern — up from 11% in 2024

- 65% said cybersecurity is a top concern — up from 50% in 2024

- 32% said staffing/recruiting/retention is a significant challenge — down from 41% in 2024

Rural hospitals have responded, in part, by discontinuing some service lines or restricting their operational hours.

Over the next two to three years, respondents saying they planned to discontinue or restrict service lines included:

- 24% for labor and delivery services

- 19% for home health or hospice

- 12% for nursing home or assisted living

- 12% for hospital-at-home care

The targeted service lines are generally low-volume, low-margin service lines.

The majority of rural hospitals have closed their maternity units, as of 2022, according to a recent study. That share of closures is higher than it is for hospitals, nationwide.

Arduino said the survey results may not capture rising concerns of rural hospital executives about potential healthcare spending cuts that are emerging from the Trump administration and the Republican-led Congress.

“It’s not to the level of panic, at all,” she said, “but an awareness of rural hospitals that [are asking] ‘What’s going to happen with our program in an administration that is focused on cutting spending?’”

The Wipfli results are based on a survey of 75 rural executives, with 85% from CAHs, at the end of 2024.