Public’s hospital views dive due to finances

Larger shares were pleased with their local hospitals than with hospitals, nationally.

The public increasingly views hospitals as primarily motivated by money and sees the government as most trusted to reduce the costs of care, according to new survey.

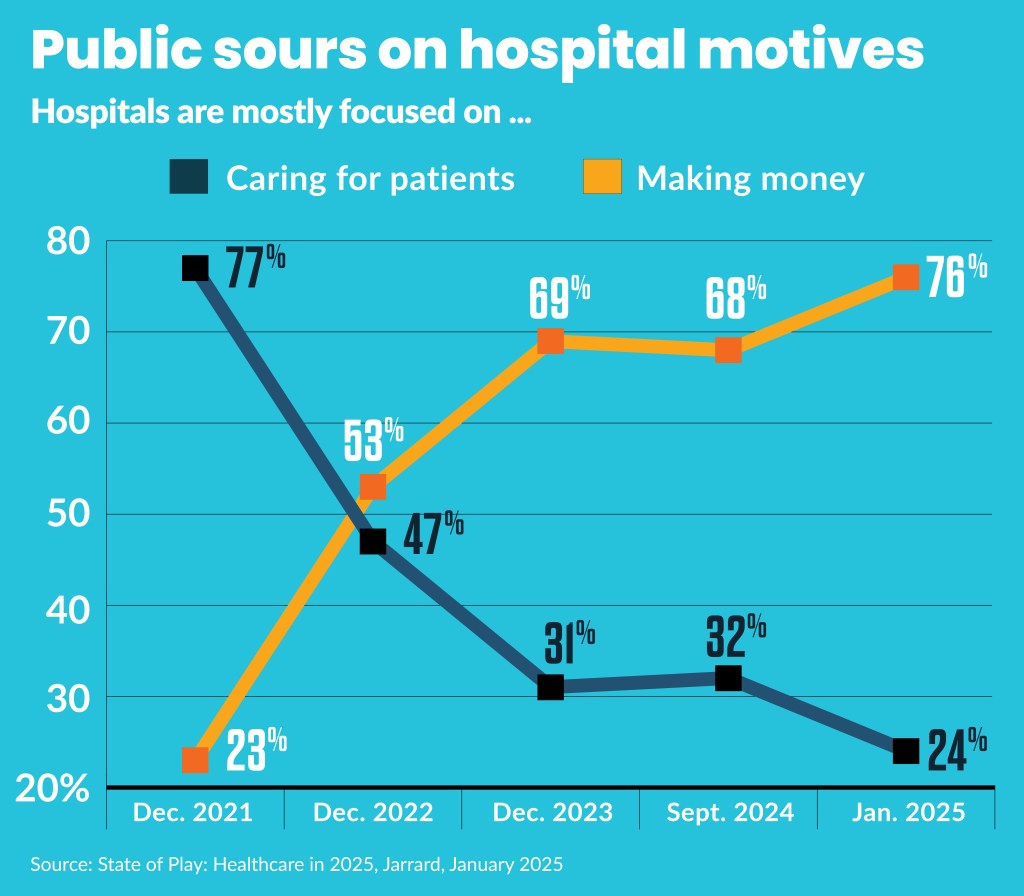

Views on the primary motivation of hospitals — earning money or providing care — flipped during the COVID-19 pandemic and have continued to worsen, according to the latest in an ongoing public survey by Jarrard, a healthcare communications consulting firm.

In 2022, 77% said hospitals were mostly focused on caring for patient, while only 23% believed they mainly focused on “making money.” That flipped by 2025 to 76% who said hospitals are primarily focused on revenue, and only 24% said they were primarily focused on patient care.

“The consumer is definitely feeling the pressure of the cost of care,” said Isaac Squyres, a partner at Jarrard.

Hospital billing may reinforce negative perceptions about hospitals’ motives, he said. Specifically, about half (46%) of respondents had different problems related to the cost of care. Those included:

- 29% had difficulty paying a medical bill

- 25% delayed medical care because of cost

- 23% avoided medical care because of cost

“That perception around the cost being a challenge flows down to the hospital in terms of [the] perception that hospitals and providers are more focused on making money than taking care of patients,” Squyres said. That perception worsened as hospital bills consumed a larger overall share of patients’ income during the recent historic surge in inflation.

Respondents had similarly negative views about payers.

Policy impact

Such negative views could fuel ongoing federal efforts to target healthcare spending.

“Given the situation that we find ourselves in at the moment with the change in administration and the potential for changes to the system of care, the fact that both hospitals and payer organizations are really upside down on the public’s trust creates a lot of pressure on both in terms of the likelihood of doing some of the things that are being bandied about and discussed,” Squyres said.

The congressional Republican majority has offered a range of preliminary healthcare cuts that could be part of the federal budget package they could enact this spring. Those include $1 trillion in 10-year direct hospitals cuts, along with other cuts that could indirectly cut hospital revenue. Additionally, the Trump administration recently targeted healthcare spending as part of its efficiency initiative led by Elon Musk’s Department of Government Efficiency.

Another way the Jarrard survey may fuel such efforts is its finding that pluralities of respondents preferred the government address, specifically, cost concerns (39%), rather than hospitals (29%) or clinicians (33%).

“The lower the public’s trust in the system of care, there are broad implications to payers and providers in terms of how people feel about the relationship that they have with those organizations,” Squyres said.

A combined 57% of those surveyed said the U.S. healthcare system needs significant reform or a complete redesign.

Findings on hospital regulation and oversight included:

- 48% said more is needed

- 22% said the current amount is right

- 10% said less is needed

Support for more regulation was higher among those who had challenges paying for care (55%) compared to those who did not (42%).

Affordability was the most-cited problem for the U.S. healthcare system. A combined 73% of respondents listed affordability among their top-three most pressing problems in healthcare.

Among specific policy changes that such negative sentiments could drive is tightening of not-for-profit hospitals’ community benefit. Forty-eight percent of those surveyed said hospitals did not provide enough community benefit, while only 38% said the amount was sufficient.

A local hope?

A positive finding from the survey for hospitals was that larger shares were pleased with their local hospitals (43%). A similar share (41%) was positively inclined toward their own insurance provider.

But that may provide a limited benefit.

“While we see that there is a little bit higher positive feeling about people’s relationship with their personal insurance or their local hospital, it’s still not a majority of people,” Squyres said. “It is a better number [than sentiments toward hospitals, nationally] but there’s still a lot of opportunity to move that number in a positive direction.”

Hospitals may improve their standing by focusing on improving the trust among their local populations, Squyres said.

“It’s important for provider organizations to be engaging at the local level and be telling a story about the quality of care they provide and the impact they have in their community to work to repair some of that trust — that they’re putting patient first,” he said.

Other signs of hope for hospitals in the upcoming policy battles include:

- 47% don’t trust the Trump administration to implement “positive changes” (versus 44% trusting)

- 57% trusted hospitals on policy, laws and solutions to improve healthcare (versus 41% trusting Trump)

- 69% trust hospitals on health information (versus 40% trusting Trump)

Outreach to local congressional representatives may be a key to prevent congressional actions that adversely affect hospitals and health systems’ finances, he said.

“Rather than relying singularly on a national advocacy effort or lobbying effort, there’s a real opportunity for local organizations to tell their local story of the potential impacts to congressman and senators, to be very clear what these potential changes’ impact would be on the constituents these elected officials represent,” Squyres said.

Leverage clinicians

While hospitals and health systems garnered trust from 57% of respondents in “developing healthcare policy, laws and solutions to improve healthcare,” nurses garnered trust from 85% and physicians had trust from 79%.

“It underscores the importance of that local influence and bringing the voices of caregivers forward in the discussion, as well as hospitals and health systems,” Squyres said.

Finance leaders also need to work with their organization’s communication departments and with hospital executives to help simplify the complex financial realities of hospital and health system finance to tell a “compelling story” in their local advocacy, he said.

“It’s not necessarily getting into ‘Here’s 340B and all of the intricacies there and here’s site-neutral payments all of the intricacies there,’” Squyres said. “The average person just isn’t going to be able to understand that.”

The survey of more than 1,000 U.S. adults was conducted in early January 2025.