News Briefs: Year-end spending bill ensures no loss of funding for Medicaid DSH payments

Year-end spending bill ensures no loss of funding for Medicaid DSH payments. The continuing resolution (CR) to keep the federal government funded through mid-March includes key healthcare provisions.

Passed Dec. 20 as essentially the last act of the 118th Congress, the CR ensured an $8 billion cut to Medicaid disproportionate share hospital (DSH) payments did not begin with the new year as scheduled.

In Medicare, the bill extends supplemental payments for low-volume hospitals and Medicare-dependent hospitals. Waivers allowing expanded Medicare coverage of telehealth services and payments for acute-care services delivered in the home also are continued for the duration of the CR.

Funding is maintained for graduate medical education, community health centers, the National Health Service Corps and the Special Diabetes Program.

All of the above provisions will need to be renewed again before federal funding runs out March 14.

Among issues that were not addressed, the Medicare payment cut for physicians in 2025 remained at the level established by final regulations. That reduction amounts to 2.83%, whereas a bipartisan CR that ended up not receiving a vote would have trimmed it to 0.33%. A few legislators pledged to negate the cut in the final FY25 budget.

CFPB pushes through restrictions on medical debt reporting

Rebuffing apprehensions of healthcare providers and debt collectors, the Consumer Financial Protection Bureau (CFPB) published a final rule to block medical debt from appearing in a consumer’s credit history.

The Jan. 7 rule represented one of the last big regulatory initiatives of the Biden administration, which said the impact will include the removal of roughly $49 billion in medical bills from the credit reports of 15 million Americans. Credit scores of affected individuals can be expected to rise by 20 points, on average, the CFPB claimed.

Eyes were on the incoming Trump administration to see whether it would move to freeze implementation before the March 17 effective date for the regulations. Some of President Donald Trump’s advisors and Republicans in Congress have criticized the CFPB for generally overreaching. A lawsuit filed by trade groups for the consumer data collection industry also represents a threat to the final rule..

The regulations prohibit lenders from obtaining and using information about medical debt when determining a consumer’s credit eligibility. A concern in healthcare circles is that patients will be less motivated to pay their bills.

Data show a spike in spending on hospital services

Accelerating hospital-focused expenditures helped spur a 2023 increase in national health spending, according to data released in December.

Spending on hospital services surged by 10.4% for the year, up from a 3.2% increase in 2022 and 3.4% for the three-year period spanning 2020-22. The 2023 increase was the biggest seen since a 10.8% jump in 1990.

Partially as a result, total healthcare spending (including clinical research and public health activities) jumped by 7.5% to reach $4.9 trillion, or 17.6% of GDP. In 2022, spending had risen by 4.6% and amounted to 17.4% of GDP.

The 2023 share of GDP still was lower than in the peak pandemic years of 2020-21 and roughly the same as in 2019.

Even amid an inflationary environment in recent years for labor, supplies and drugs, prices of hospital care have been relatively stable. Increases were 2.8% in 2022 and 2.7% in 2023. For healthcare overall, prices rose by 3% in 2023.

Use and intensity of services were more significant factors in the 2023 spending increase, CMS actuaries posited. For example, hospital discharges rose by 1.6% after dropping slightly in 2022.

MA plans reap a payment increase in proposed rate notice

Medicare Advantage (MA) health plans would receive a 2.2% payment benchmark increase in 2026 after incurring reductions the past two years, according to a proposed rate notice issued Jan. 10 by the Biden administration.

When factoring in a projected risk-score increase based on the severity of beneficiaries’ health conditions, plan payments would rise by 4.3%, or $21 billion.

A rise in a metric that measures cost growth in Medicare helped spur the proposed increase, which represents a boon for health plans after their payment benchmark dropped by 1.1% in 2024 and 0.2% this year.

A finalized version of the rate notice is due out by early April, giving the Trump administration time to potentially make modifications.

Medicare financial support for low-wage hospitals hits another appellate-court roadblock

Plaintiff hospitals won a second consecutive appeals-court victory in the legal fight over Medicare’s low-wage-index policy.

In December, the San Francisco-based U.S. Court of Appeals for the Ninth Circuit upheld a district court’s ruling that the policy of increasing wage-index values for rural hospitals starting in 2020 was statutorily impermissible.

The decision echoed a July ruling by the Washington, D.C., circuit court. The dual decisions make it less likely that the case will proceed to the Supreme Court, although HHS said it is considering its options.

In accordance with the policy, hospitals in the lowest quartile of the wage index received an increase that brought up their index value to the halfway point between their actual number and the 25th percentile.

HHS was planning to maintain the policy through FY27, saying it wanted to continue evaluating the impact over a period of non-pandemic years. However, the department scrapped that proposal after the D.C. court’s ruling.

A transitional policy then was implemented to ensure no affected hospital faces a wage-index decrease of more than 5% in FY25. Unlike with a similar policy that has been in place for all hospitals, there is no corresponding budget neutrality requirement.

MedPAC seems set to recommend an additional hospital payment boost

Hospitals improved financially in the latest reporting period but still should receive a supplementary Medicare payment increase, the Medicare Payment Advisory Commission concluded in a recent meeting.

For 2026, Congress should authorize a 1% increase beyond the amount calculated using the statutory methodology, commissioners said during a December discussion.

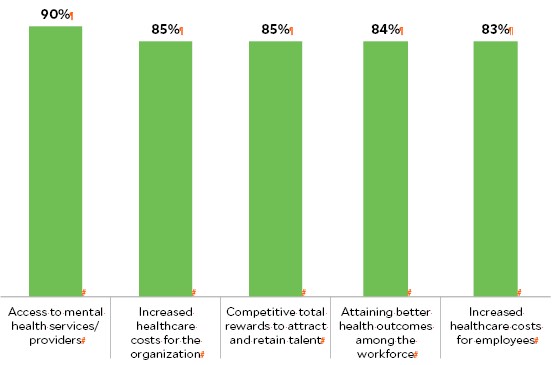

Top workforce concerns for hospital HR departments

employers, as reflected in a survey of more than 1,500 organizations. Above

are the issues most frequently cited as “extremely important.”

Source: Aon, “2024 benefits survey of hospitals,” December 2024