The pace of hospital rating downgrades slowed in 2024: Five key takeaways

Rating downgrades continued to outpace upgrades in 2024, although at a lower rate than in 2023.

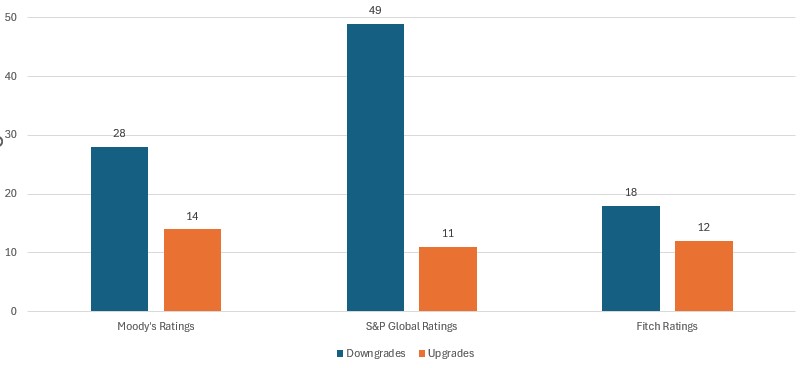

When combining the rating actions of the three rating agencies (Fitch Ratings, Moody’s Ratings and S&P Global Ratings), the number of downgrades (95) declined in 2024 while the number of upgrades (37) increased, compared with 116 and 33, respectively, in 2023.

Rating agency downgrades versus upgrades, 2024

Many of the downgrades reflected ongoing expense pressure that exceeded revenue growth, even as volumes headed back to pre-pandemic levels and the use of contract labor declined. Other downgrades reflected outsized increases in debt to fund pivotal growth strategies. Most of the upgrades reflected mergers of lower-rated hospitals into higher-rated systems. Rating affirmations remained the majority rating action in 2024, as in prior years.

Key takeaways from recent actions include the following.

- The ratio of downgrades to upgrades narrowed at Moody’s (2.0-to-1 in 2024 compared with 3.2-to-1 in 2023) and Fitch (1.5-to-1 compared with 3.5-to-1). S&P saw a wider spread in the ratio (4.5-to-1 in 2024 compared with 3.8-to-1 in 2023).

- Downgrades reflected a wide swath of hospitals, from small independent providers to large regional systems. Large academic medical centers and children’s hospitals saw downgrades, even with exclusive tertiary services that provided differentiation with payers. Shared, recurring downgrade factors included weaker financial performance, payer mix shifts to more governmental and less commercial payers, and thinner reserves. Many of the downgrades were concentrated along the two coasts: California and the Pacific Northwest and New York and Pennsylvania. Many of the ratings were already in low or below investment grade categories.

- Multi-notch downgrades continued in 2024, ranging from two to four notch movements in one rating action. One of the hospitals that experienced a four-notch downgrade subsequently defaulted on an interest payment (Jackson Hospital & Clinics in Alabama). Multi-notch upgrades reflected mergers into higher-rated systems, the largest being a seven-notch upgrade of a small, single-site hospital into a 19-hospital system in the Midwest.

- Five hospitals experienced multiple rating actions in 2024, with rating committees convening not once but two and three times during the year. These were distressed credits whose financial performance and reserve levels dropped materially from quarter to quarter, a characteristic of high-yield or speculative rated borrowers.

- While some of the upgrades followed mergers, other upgrades reflected improved financial performance and stable or growing liquidity. Likewise, some of the upgraded hospitals began receiving new supplemental funds known as Direct Payment Programs (DPPs). Unlike other supplemental funds, DPPs are subject to annual federal and state approval, making their long-term reliability uncertain. Numerous types of providers saw upgrades — including academic medical centers, independent hospitals and regional health systems — and were located across the United States. Most of the upgraded hospitals (excluding those involved in mergers) were already investment grade.

As in past years, rating affirmations represented the overwhelming majority of rating actions in 2024. This is welcome news for the industry as many hospitals and health systems will turn to the bond market to borrow for their capital projects. Investors’ view of the industry should be bolstered by the change in industry outlooks. S&P moved to stable from negative and Fitch moved to neutral from deteriorating in December 2024, joining Moody’s revision to stable from negative in 2023.

We expect rating affirmations will again be the majority rating action in 2025. However, even with the stability viewed by the agencies, we expect downgrades to outpace upgrades given a growing reliance on government payers, labor challenges and a competitive environment. Policy and funding changes will also cast uncertainty into the mix in 2025 and may cause credit deterioration in future years.