Employers turn to direct contracting as hospital costs continue to rise

The new data tool comes as hospitals have divergent approaches to direct contracting.

A new data tool that combines price, quality and safety for healthcare purchasers aims to provide fuel for the latest direct contracting push.

The information could lead employers to not only increase their use of direct contracting but cause them to rethink the hospitals with which they choose to contract.

“One of the things that we also saw — and a lot of employers were shocked by — through this project was the lack of perceived quality at facilities that they otherwise thought they were getting high-quality care from,” said Raymond Tsai, MD, vice president of advanced primary care for the Purchaser Business Group on Health (PBGH).

The tool, called the Health Care Data Demonstration Project, from PBGH, combines hospital prices (reported under federal requirements), quality data (from Embold Health) and safety data (from Leapfrog Group) for employers.

Elizabeth Mitchell, president and CEO of PBGH, said that despite the administrative complexity of direct contracting she expected this type of data to drive further increases in its use.

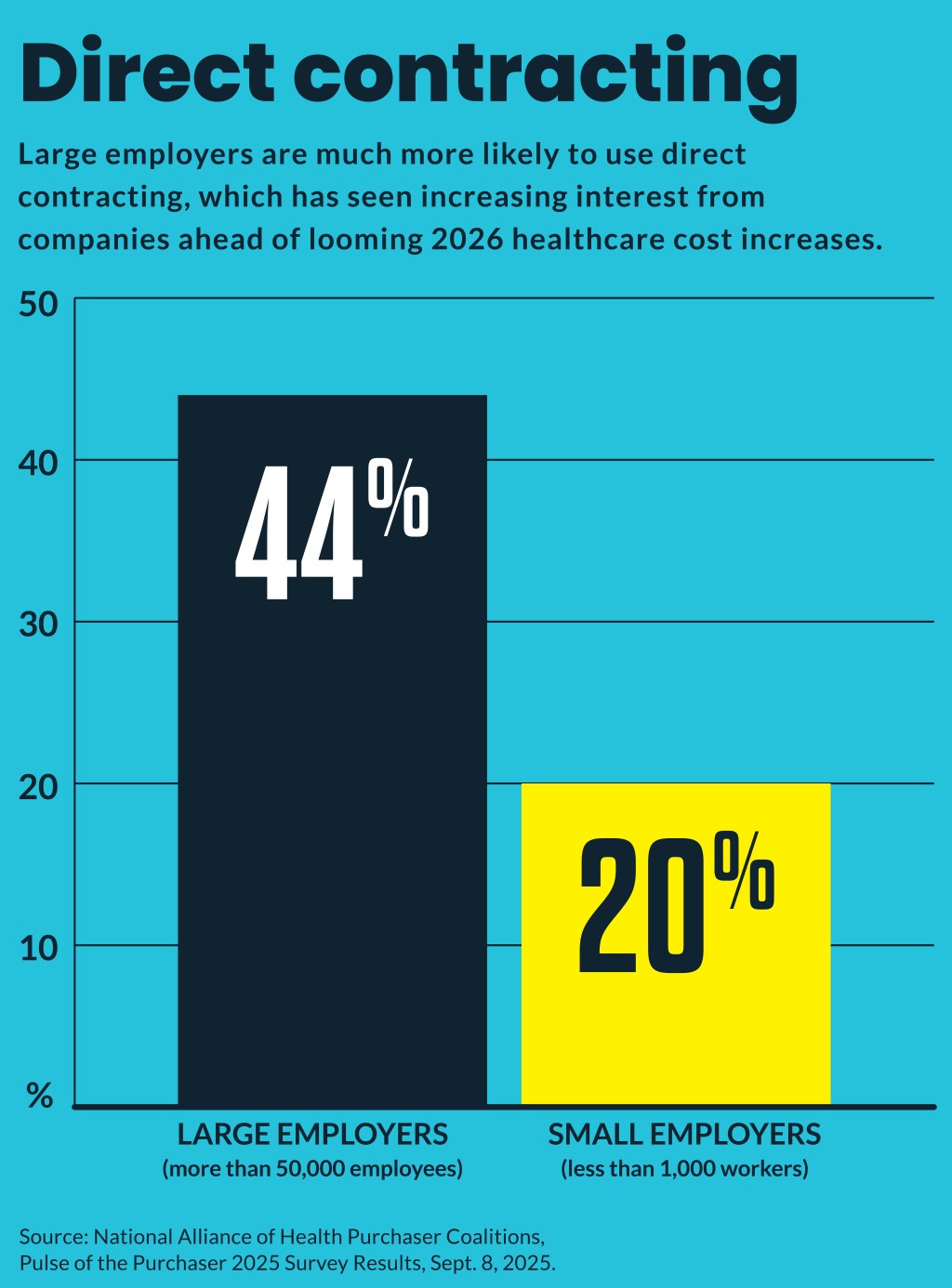

Forty-four percent of large employers (more than 50,000 employees) use direct contracting with high value hospitals, as do 20% of those with less than 1,000 workers, according a NAHPC survey (free download required).

The demonstration tested the combined data for five large employers to show them how their provider payments compare to national commercial benchmarks, identify high-value providers and target the areas where they are being overcharged.

Mitchell said potential savings identified varied widely in type and amount between markets but ranged from 10% to 60% savings for employers. For instance, in one market it found that employers could garner double-digit savings just by re-contracting with their existing providers at the lowest rate those providers gave to other employers.

“One of our members found they were paying 30% more than any other carrier in one market,” Mitchell said. “Another one was able to quantify that their direct contract was higher value than any of the UnitedHealthcare contracts that they had signed.”

PBGH plans to roll out the tool in the coming months for other large employers looking to control costs, improve quality and drive healthcare marketplace competition. Widespread use of the data would likely not occur until the 2027 coverage year, Mitchell said.

Some employers have found hospitals with which they directly contracted backed out after financial losses, she said. But Mitchell expected the true high-value hospitals to benefit from the greater data transparency and benefit from such contracts.

Why now

Shawn Gremminger, president and CEO of the National Alliance of Healthcare Purchaser Coalitions (NAHPC), said employers are increasingly worried that hospital costs are accelerating.

The leading drivers for that increase, he said, are:

- Increasing consolidation

- Accelerating cuts to Medicare and Medicaid

“And it is possible that hospitals are seeking to make up for those cuts by cost shifting onto employers and purchasers,” said Gremminger. “That’s a somewhat controversial claim, but there does seem to be a correlation between the higher prices that we’re seeing right now and the cuts to public reimbursement.”

The increasing employer push put hospital prices under the microscope is not just driven by their concerns that those providers are charging higher prices. Other factors fueling it are concerns that employers face potential legal liability as fiduciaries for their employee health costs. That requirement came out of the Consolidate Appropriations Act of 2021.

Mitchell specifically credited the tool as a way for employers to “fulfill their fiduciary duties.”

Employers also are scrambling for ways to respond to the steepest increase in healthcare costs in more than a decade. Multiple employer surveys in recent weeks have projected 2026 cost increases for businesses approaching 10% in 2026. Small employers are projected to face even steeper 2026 healthcare cost increases.

Other savings

In recent years, the leading way employers have found savings in hospital costs has been to redirect a relatively small number of their plan enrollees from high-cost sites.

Such enrollees are usually far past their deductible, so none of the financial steering tools are applicable to redirect them from high-cost settings, he said. So, employers provide them with lower-cost alternative settings that may appeal to enrollees based on comfort or convenience.

“’Would you rather be at home? Would you rather be in a clinic that’s a mile away rather than the hospital that’s 10 miles away? It’s entirely your choice. We’re not putting any pressure on you either way,’” Gremminger said in describing how alternative sites of care are discussed. “But again, most of the time, you know, people would rather not have to go to the big hospital, walk a long distance, be around a bunch of sick people, you know, the whole thing, particularly in a medically fragile state. They would rather the convenience.”

Such conversations with plan enrollees facing a high-cost treatment are worth it for employers, he said, because they can save employers hundreds of thousands of dollars in annual cost for each patient. For example, they found large potential savings from shifting infusions — 55% of which occur in hospital settings — to lower cost sites.

Forty-eight percent of large employers use such site-of-care redirections and even 28% of employers with less than 1,000 workers use them, according to an NAHPC survey.