California hospitals sue to stop state cost control board’s spending caps

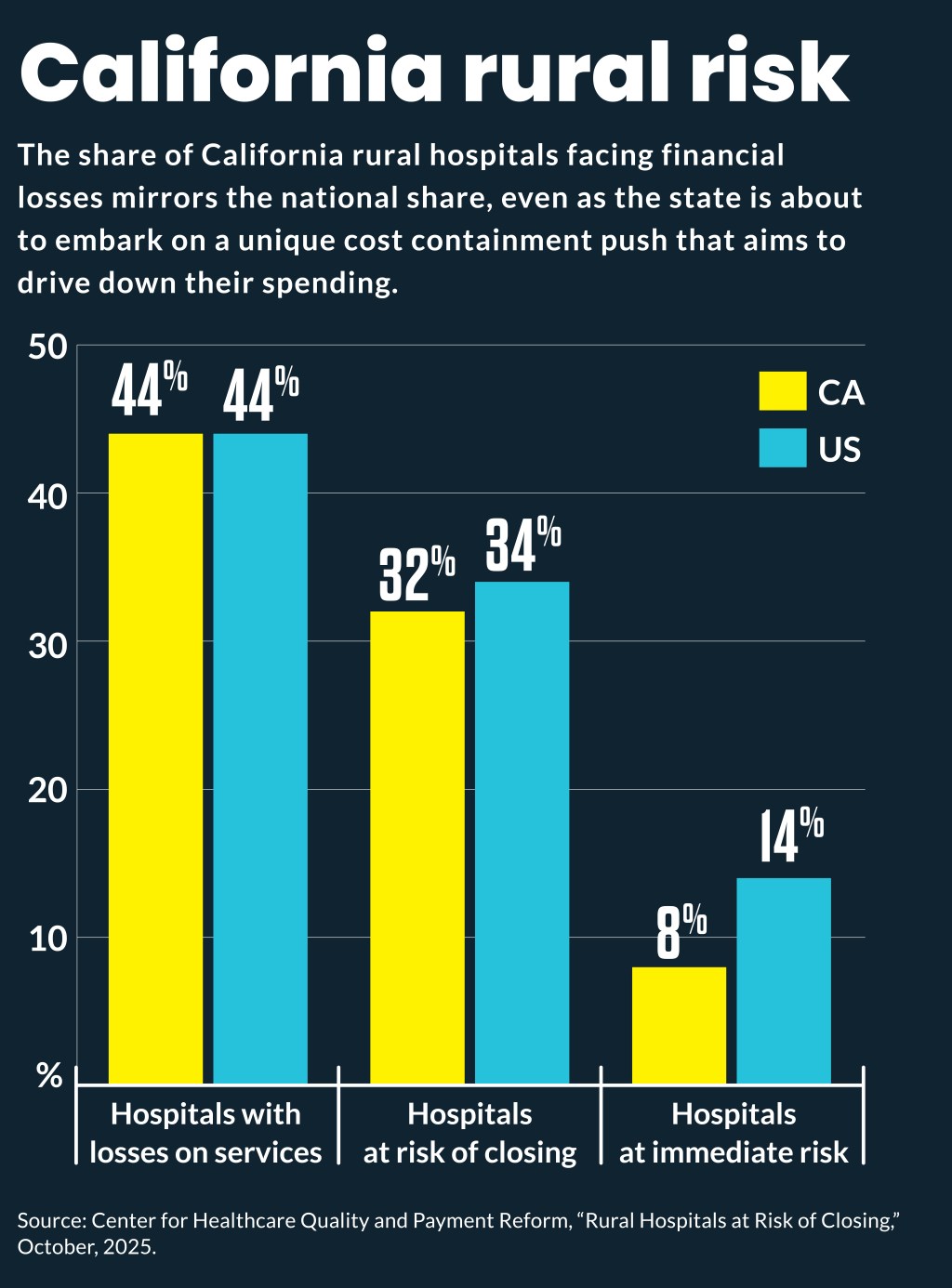

The cost reduction targets would push 83% of the state’s hospitals finances into the red, according to a provider survey.

California’s cost control board is a sharp departure from such boards in other states and needs to be stopped, according to a lawsuit from state hospitals.

The California Hospital Association (CHA) filed a lawsuit against the California Office of Health Care Affordability (OHCA) on Oct. 15 to stop spending tracking that would produce “potentially substantial monetary penalties” by 2028.

“OHCA has unfairly targeted hospitals without the necessary research and analysis” Carmela Coyle, president & CEO of the CHA, said in a press release. “This has resulted in a handful of unelected individuals who have chosen to cut billions from California’s health care system, endangering access to health care in vulnerable communities across the state.”

The OHCA, which was created by the state’s legislature, set limits on hospitals spending increases to 3.5% beginning in 2025, and then will lower the cap to 3% annually by 2029. An even more aggressive spending increase cap of 1.8% for 2026 was set for seven hospitals designated as “high-cost.” Their spending limit would decrease to 1.6% by 2029.

“Yet, as a result of OHCA’s failures to consider or integrate into the cost target methodology key factors that drive hospital spending, it may simply not be possible for some hospitals to comply with these cost targets,” said the lawsuit.

The lawsuit challenged the spending caps as unconstitutional; sought to block enforcement of cost targets without a plan for how the state will assess compliance; and sought to prohibit the state from applying the spending caps on hospitals.

Among CHA’s objections were that the OHCA ignored underlying costs of care, such as labor expenses, pharmaceutical prices, a rapidly aging population, national and statewide inflation and looming federal cuts under the One Big Beautiful Bill Act (OBBBA).

Hospital surveys cited by the lawsuit found the cost reduction targets would cut nearly $5 billion from patient care by 2029, cost more than 10,000 healthcare jobs and result in 83% of the state’s hospitals operating in the red.

“These cost targets effectively limit the annual increase in the reimbursement hospitals may receive, including from commercial health plans, which have historically been based on market-driven, arms-length contract negotiations between the payer and the hospitals,” said the lawsuit by CHA, which represents about 400 hospitals.

Supporters of the OHCA countered that its approach was needed to make care more affordable for state residents.

“This outrageous lawsuit isn’t about quality care, it’s intended only to prop up excessive executive compensation and hospital profits. It’s shameful that the hospital industry is hiding behind the issue of systemic health disparities in order to justify their excessive profits, which are keeping health care prices out of reach for Californians,” Kiran Savage-Sangwan, executive director of the California Pan-Ethnic Health Network said in a press release.

Departure from other states

The lawsuit noted that California is one of a number of states that have implemented cost control initiatives but it differs from them in significant ways.

“[I]t is of note that other states with statewide cost targets are meaningfully distinct in what they consider,” said the lawsuit.

It noted Connecticut and Rhode Island have adjusted their cost targets to consider inflation. In Rhode Island, cost targets for 2023 were set at 6% to account for the lagged impact of the 2021 to 2022 nationwide inflation spike.

Massachusetts and Oregon took many years to develop cost targets after carefully reviewing and analyzing data.

Additionally, other states with cost targets, such as Massachusetts and Oregon, do not exclusively focus their cost targets on hospitals.

OHCA also focused its cost targets on median household income growth, which failed to account for multiple factors that impact health care spending, said the lawsuit. CHA said it should consider and reflect inflation, demographic factors, trends in labor and tech costs, impacts of COVID-19, costs of new pharmaceuticals, federal changes to Medicaid, state mandates.

On the OBBBA, CHA estimated it will reduce California hospital payments under Medicare and Medi-Cal by at least $66 billion to $128 billion over the next 10 years.

State costs

The demand for hospital spending reductions also comes as hospitals face costs from California seismic safety standards, which require hospitals to remain fully operational after major earthquakes by 2030.

The seismic upgrades needed to bring all hospitals in compliance with the 2030 requirements may cost as much as $143 billion, according to a 2019 study by the RAND Corporation.

Additionally, new state laws are phasing in $25 per hour minimum wage increases for healthcare workers.

Data mismatch

A core complaint of CHA was that OCHA hurried its analysis and produced the cost containment targets two years faster than required by the underlying state law, which resulted in inaccurate findings.

CHA cited data from the CMA Office of the Actuary that found that despite California’s high cost of living, statewide per capita healthcare spending ranks the 23rd highest nationally. Additionally, hospital-specific spending is even lower, ranking 34th nationally.

The lawsuit highlighted that the rate of labor costs for hospitals in the western region of the country has grown in recent years at 6% annually to illustrate the problem with the lower OHCA cost targets.

“In so doing, OHCA never explained how hospitals are to manage something like a 6% increase in the cost of labor while limiting the increases in revenue to from 1.6% to 3.5%, particularly since labor costs comprise about one-half of hospital costs,” said the lawsuit. “OHCA actions will therefore result in massive layoffs of health care workers, leaving hospitals understaffed and jeopardizing quality of care for patients.”

CHA noted the spending caps would impact the ability of hospitals to negotiate for increased payments from non-governmental payers to offset at least some of reduced payments under OBBBA. It noted some commercial payers are already limiting payment rates for California hospitals, citing the OHCA cost targets.