Employers underestimate employees’ healthcare affordability struggles, survey finds

Some providers have seen large increases in bad debt and charity care costs among patients with job-based insurance.

Workers with employer-sponsored insurance (ESI) face substantially more affordability problems than their companies realize, according to new national survey data.

Forty-four percent of employees say they couldn’t pay $1,000 in out-of-pocket (OOP) costs, but most employers (78%) believe their employees can meet their financial healthcare obligations, according to the 15th annual Aflac WorkForces Report. Additionally, 19% of workers said they couldn’t even afford $500 in healthcare costs.

“These aren’t just abstract numbers. Rather, they reflect very real anxieties about navigating the cost of care,” said the report. “When employees feel unprepared, it can ripple across their work life, contributing to stress, delayed care and disengagement.”

Employers also believe that employees have a better understanding of their total out-of-pocket health care costs than they actually do (72% vs. 54%), according to survey.

The employee-employer disconnect came amid recent employer survey results by KFF that premiums for job-based health insurance increased in 2025 by an average of 6% for family coverage — to $26,993 — and by 5% for individual coverage — to $9,325.

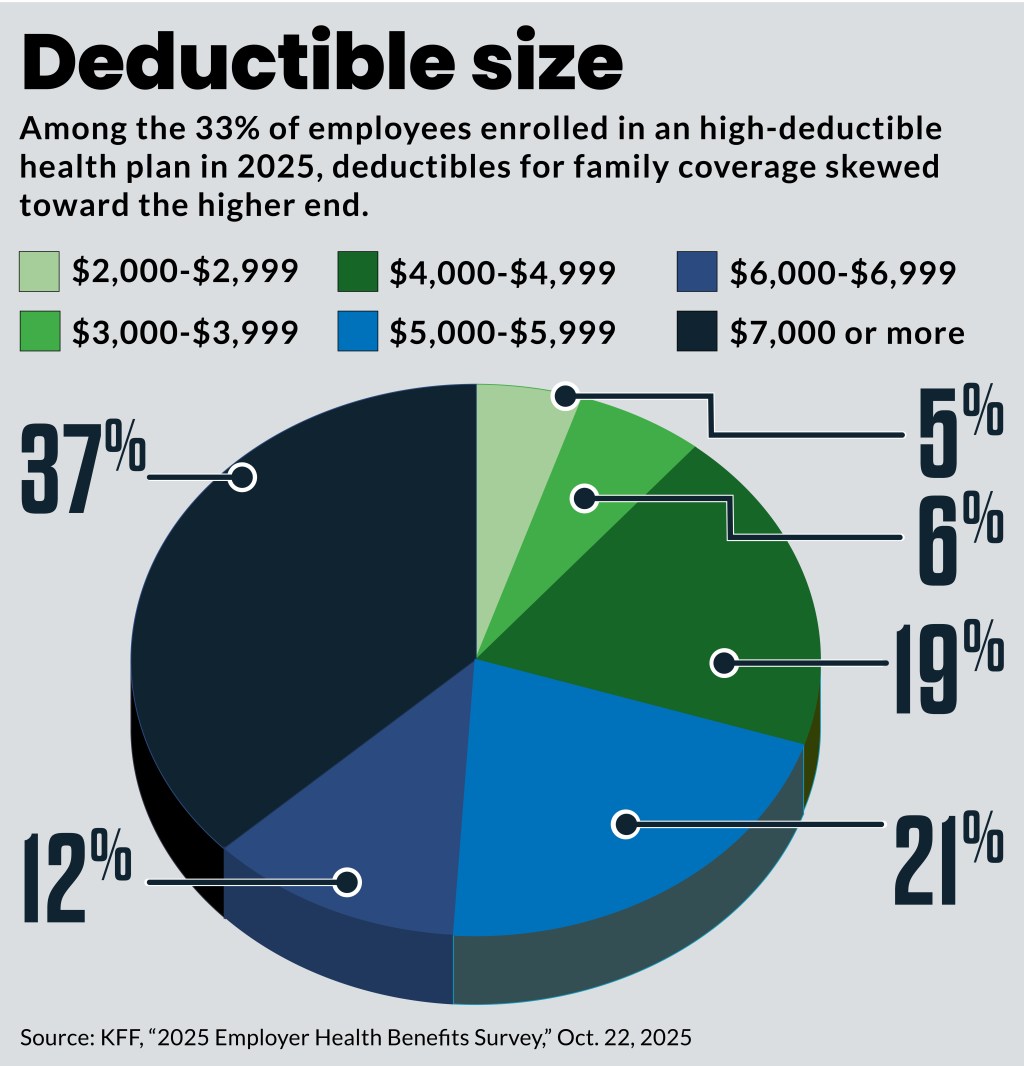

Additionally, 33% of covered workers — the most in the KFF survey’s 20-year history — were enrolled in a plan with a deductible of more than $1,000 for single coverage and $2,000 for family coverage. Thirty-seven percent of enrollees in high-deductible or health reimbursement arrangements for family coverage had deductibles of more than $7,000.

Concerns differ by age

The share of workers in the Aflac survey who said they would not be able to cover a $1,000 unexpected OOP expense included:

- 51% of Gen z

- 45% of millennials

- 44% of Gen x

- 30% of baby boomers

The Aflac survey also found more than half (52%) of all employees worry about health care costs that are not covered by insurance, and younger employees felt that most strongly.

The share of employees reporting high anxiety about non-covered costs included:

- 61% of Gen Z

- 52% of millennials

- 50% of Gen X

- 47% of baby boomers

Employee confidence in their coverage has declined over the past year, with fewer workers feeling assured they would be well protected if faced with a major health event. Fifty-eight percent of employees said they were confident they would be well-covered in the event of a serious illness, compared to 64% who said that in last year’s survey.

Provider experience

For healthcare provider organizations, the increasing affordability challenge for patients with ESI coverage has shown up in an increase in bad debt and charity care costs.

“If patients choose to leave the network for a rare tumor expert, they will have to do so under the out of network benefits portion of their insurance. This comes with a much higher deductible and out of pocket cost which is a direct cost to patients,” said Billy Laing, CFO for City of Hope Arizona. “This cost acts as a barrier to care and restricts patients from seeing experts they may need.

That trend has resulted in a “dramatic increase” in the out of network deductibles and other out of pocket costs among their patient with ESI coverage.

“We partner with patients on charity options to reduce this cost if they choose to access our care,” Laing said.

Affordability responses

Multiple employer surveys in recent weeks have projected 2026 cost increases for businesses approaching 10% in 2026. Smaller employers have much larger average increases. In response, businesses — especially large employers — say they are undertaking more initiatives aimed at controlling hospital costs.

Other employers are increasingly considering and adopting alternative health plans to counter historic cost increases. In 2026, 24% of employers in one survey said they will have one of these offerings in place either as an option or a standalone plan. Another 36% are considering this option for 2027 or 2028.

Another option is the adoption of individual coverage health reimbursement arrangements (ICHRAs), in which employers provide fixed amounts to help workers purchase their own coverage in the individual market.

“We see lots of groups who are getting tired of the fully insured merry-go-round that they are on with 15%, 20%, 30%, 40% increases annually and moving to the ICHRA gives them an opportunity to get their arms around their budget a little bit more predictable with their annual spend,” said Ben Light, vice president of partnerships at Zorro, which assists companies in the use of ICHRAs.

Employers look at affordability in two ways. The first is the technical definition of coverage affordability, 9.02% of household income, as established by the Affordable Care Act. But that increases to 9.96% of income for 2026.

“So, the government has said, ‘Going into next year, you can push 10% more to your employees,’” he said.

Beyond the technical definition of affordability is the practical question of whether coverage costs within those limits are affordable in the reality of workers’ lives.

“If I make $47,000 and you’re telling me to buy insurance that costs $2400 a year, do I have $2400 to send on that when I’m looking at rent and car payments and food and child care?” he said.

Employers believe their employees find the ICHRA coverage affordable because they rarely drop that coverage. Affordability may be helped by their ability to select lower metal tiers that have lower-cost premiums, Light said.

Employers want to offer coverage, but its cost has become their second largest line item after salaries, he said. That tension has led a growing number of companies to choose between offering coverage and not firing some of their staff, given the costs.

The ongoing fight over COVID-era ACA marketplace subsidies does not affect workers provided with ICHRAs to purchase coverage there because they are ineligible for subsidies.

The projected 2026 surge in premium costs for the ACA marketplace also may have less effect on ICHRA decisions because those increases are less than premium increases employers — especially small ones — face when purchasing coverage for smaller pools of workers, Light said.

Most ICHRA funds are used to purchase coverage off the ACA marketplace, which follow the same coverage rules.

ICHRA coverage remains small — an estimated 350,000 to 700,000 enrollees, according to the HRA Council — but Light was optimistic policy changes and insurance company trends would boost that. For example, the One Big Beautiful Bill Act (OBBBA) made bronze and catastrophic plans eligible for health savings accounts (HSAs) for the first time.

Another OBBBA change allowed use of HSAs to fund direct primary care (DPC) arrangements. The combination could allow ICHRA funded employees to buy a cheaper bronze plan for catastrophic coverage and get most of their care from a DPC arrangement, he said.