AI adoption in healthcare finance lags despite claims process promise

Providers looking toward AI comes amid a worsening claims denials challenge.

Despite two-thirds of healthcare finance professionals seeing the promise of AI to improve the claims processes, only 14% have unleashed it on claims denials, according to a recent survey.

The disconnect between views on the ability versus uses of AI in the revenue cycle process came from the 2025 Experian Health State of Claims Report, which was based on a quantitative survey of 250 healthcare professionals responsible for financial, billing or claims management decisions.

“The disparity between interest, knowledge and actual implementation of AI is certainly a major takeaway from our survey,” Clarissa Riggins, chief product officer at Experian Health, said in an email. “We see this as a paradox where enthusiasm is tempered by operational concerns, which act as significant barriers to adoption.”

Respondents’ concerns with AI use centered around accuracy, HIPAA compliance and the complexity of training teams.

Among the 14% who said their organization is currently using AI:

- 10% developed it in house

- 40% use a vendor product

- 49% use a combination of in-house and vendor AI

The Experian Health survey painted a starker picture on AI use than a recent survey by HFMA and analyzed by Solventum. That May-June survey of 272 healthcare directors, presidents, CFOs, managers and other members of HFMA found about half of organizations have already implemented AI-driven solutions in mid-revenue cycle workflows (e.g., coding, denials management, clinical documentation improvement).

However, the 67% of respondents to the Experian Health survey saying AI can improve the claims process points to continued expansion in its use.

“Adoption numbers will continue to grow as AI goes from a theoretical solution to a vital tool that can streamline workflows, reduce administrative burdens, identify patterns in patient data, predict coverage risks, and automate repetitive tasks, freeing up staff,” Riggins said.

Overall challenge

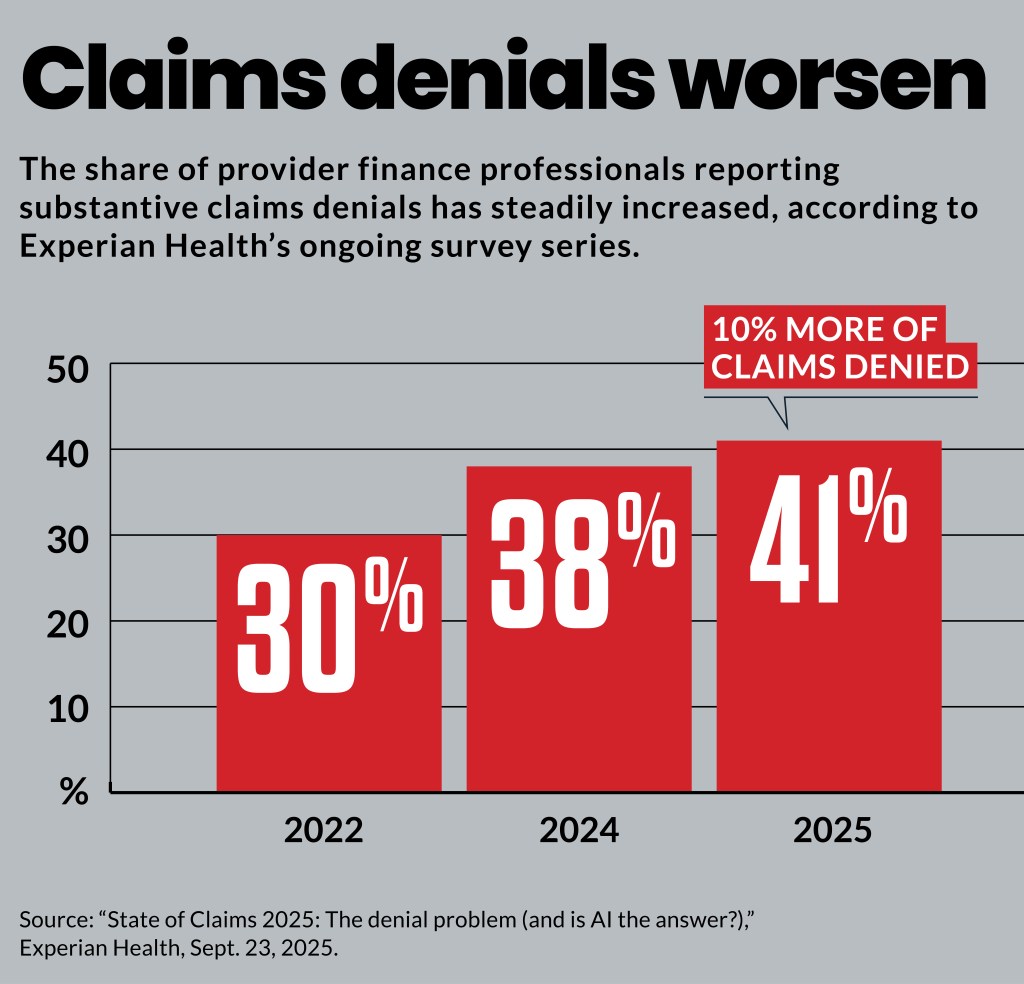

Providers looking toward AI comes amid a worsening claims denials challenge. The share saying that 10% or more of their claims are denied, based on Experian Health’s ongoing survey series, include:

- 41% in 2025

- 38% in 2024

- 30% in 2022

More than one-third (37%) of healthcare organizations said in the HFMA survey that clinical documentation and coding discrepancies have a negative financial impact on their organization of at least $1 million. Moreover, 12% estimate the impact at more than $5 million.

Driving the trend

Among the factors triggering denials, “missing or inaccurate claim data” was by far the largest, according to the Experian Health survey. Respondents said the triggers for denials included:

- 50% missing or inaccurate claim data

- 35% authorizations

- 32% incomplete or incorrect patient registration data

- 24% code inaccuracy

- 23% services not covered

The prominent role of missing or inaccurate claim data in triggering a denial is not surprising, Riggins said, since as little as one incorrect digit or incomplete piece of information can be a cause for denial.

“While payers can explain more fully how they evaluate claims and criteria for denials, what our survey results signal is that traditional and reactive approaches are simply not enough,” Riggins said.

Underlying factors that drive the data challenges focused on staffing capacity and technology. For instance, the survey found that 43% of providers said they are understaffed. That compared to 30% that reported staffing shortages were a cause of operational challenges that increased denials in 2022. Additionally, 100% of respondents said in 2023 that staffing shortages affected RCM and patient engagement efforts.

“The complexities and sheer volume of claims within a fast-paced environment expose the vulnerability of understaffed teams,” Riggins said.

In addition, many providers are using outdated technology. Just over half (56%) of providers said their current technology is sufficient to address RCM demands, which is significantly lower than in 2022, when it was 77%.

“This paints a clear picture that providers are stuck in a challenging cycle of data errors, delays, and denials,” Riggins said.

Another technology challenge was that 81% said their organization uses multiple systems for check-in, which can cause inefficiency and redundancy to intake workflows.

“These fragmented systems may also contribute to longer times running eligibility checks,” Riggins said. “Organizations that are breaking the cycle are updating workflows to catch errors early and focus on preventing claim denials.”