News Briefs: Medicare offers a restrained inpatient payment update for FY26

Hospitals collectively will receive a base payment increase of 2.6% in Medicare reimbursement for inpatient care provided in FY26, according to a final rule published Aug. 6 in the Federal Register.

Advocates were seeking a bigger update. With rising costs and reimbursement constraints projected in upcoming years, especially after passage of the budget reconciliation bill known as the One Big Beautiful Bill Act, the increase may not offer much of a cushion when the new fiscal year begins Oct. 1.

“The anticipated increase is not sufficient to make up for the recent historic levels of inflation nor expected increases in the number of uninsured Americans,” Chip Kahn, president and CEO of the Federation of American Hospitals, said in a written statement.

As it does every few years, CMS is rebasing the hospital market basket, which contains various cost inputs that are used to determine the annual Medicare payment update. Per the revision, the labor-related share of the market basket is dropping from 67.6% to 66%. One result is that a hospital’s wage-index adjustment will be applied to a lesser share of overall payments and thus will translate to less funding.

Medicare uncompensated care payments take a big jump

A bright spot for hospitals in the FY26 inpatient payment final rule is the expected $2 billion boost in uncompensated care payments to Medicare disproportionate share hospitals (DSH).

The payments will vary considerably based on a hospital’s DSH percentage but nonetheless represent a major turnaround from FY25, when they dropped by more than $200 million.

The American Hospital Association expressed appreciation that “CMS’s payment updates and support for hospitals that treat a disproportionately high number of low-income patients are improved in this final rule. However, we are still concerned that these updates are not adequate enough for the many hospitals that are struggling in today’s challenging operating environment.”

Among other supplemental payments in the FY26 final rule, outlier payments for high-cost cases are projected to be 0.3% higher than in FY25, mainly because CMS’s simulations indicate outlier payments will fall short of the target figure this year. The program for new-technology add-on payments will increase by an estimated $192 million.

340B rebate models arrive in the form of a new pilot program

Federal healthcare officials took a step toward permitting rebate models in the 340B Drug Pricing Program, launching a pilot to test such models.

The concept was proposed over the past year by drug manufacturers looking to rein in what they say are excesses of the 340B program. Rather than giving hospitals and other covered entities the 340B discount up front, the companies think providers should pay the full price before submitting claims data to receive a rebate.

The scope of the pilot program initially will be limited to the 10 drugs that have been subject to price negotiations in Medicare for 2026. That’s significantly narrower than the proposals of several manufacturers that had sought to use a rebate model for all drugs they sell in 340B.

Guidance from the Health Resources and Services Administration (HRSA) includes guardrails to ease the burden on hospitals and other 340B covered entities, such as ensuring that they have 45 days from date of dispense to submit and report the data required to receive a rebate, and that rebates are paid within 10 days of data submission.

HRSA also says manufacturers must not pass on any costs of implementing the model.

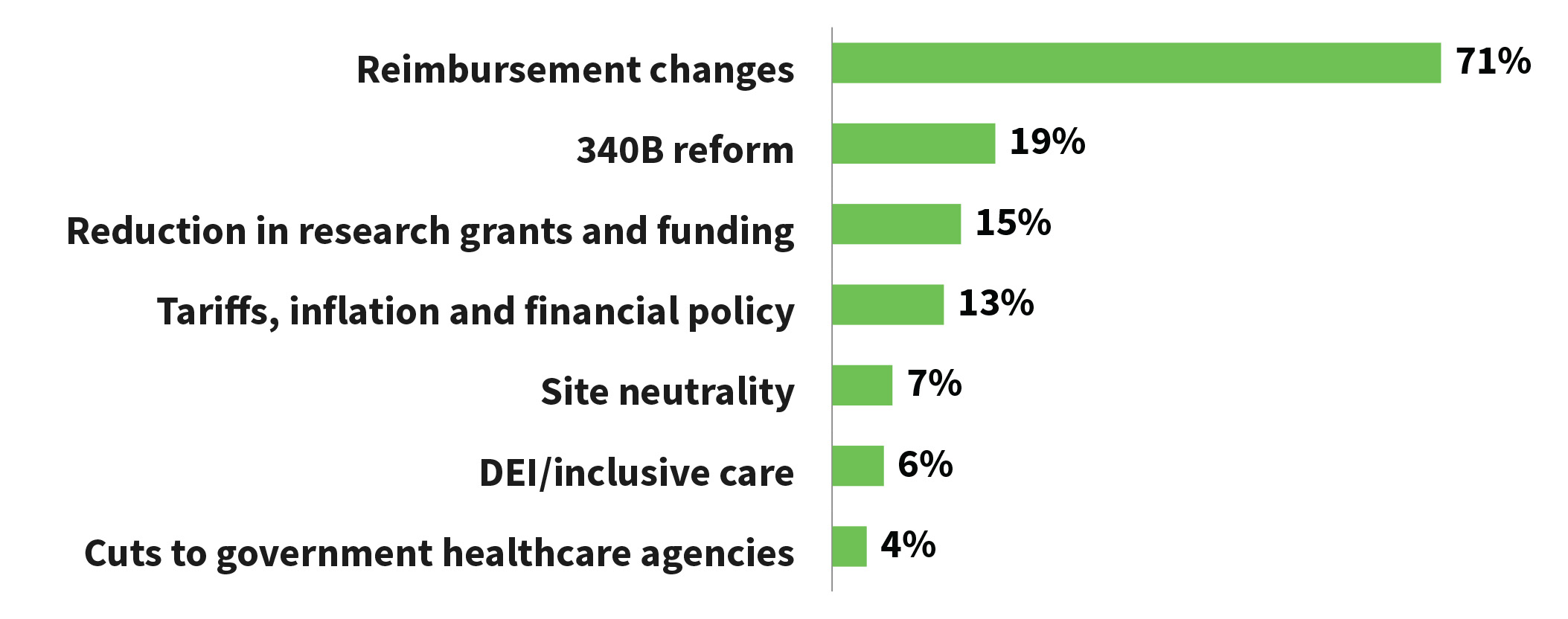

Federal policy changes with the biggest anticipated impacts

KLAS Research surveyed executives of 169 healthcare delivery organizations to gauge the biggest projected impacts of ongoing or pending federal policies (respondents could select multiple answers).

Aetna’s new payment policy could leave hospitals at a disadvantage

In a recent communication, Aetna said hospitals that contract with the company’s Medicare Advantage plans and Medicare Special Needs Plans face a new policy beginning Nov. 15 in instances when a patient is admitted on an urgent or emergency basis and the stay spans at least one midnight.

Aetna intends to approve most admissions without a medical necessity review, then pay the claim at roughly the observation rate. The inpatient rate would be subsequently paid only if the stay qualifies based on MCG Care Guidelines admission status criteria. In apparent contravention of established regulations, payment for care episodes that stretch over two or more midnights could be limited to the lower rate.

Hospital advocates say the risk is that billing systems will interpret the difference between the payment and the billed amount as a contractual adjustment and thus will consider the admission fully paid. Facilities should adjust their billing software to flag pertinent Aetna payments for manual review and action beginning Nov. 15, giving them a chance to challenge the lower payments where appropriate.

Blue Cross Blue Shield litigation settlement yields $1.85 billion for providers, while thousands opt out

Close to 6,500 provider organizations chose to opt out of the $2.8 billion class-action settlement with Blue Cross Blue Shield in a long-running antitrust case, according to court documents.

Per a filing by plaintiffs’ attorneys, more than 1 million settlement claims were submitted as of July 27. The attorneys said the opt-outs represent less than 1% of a class that consists of essentially all providers that do business with the Blues. The incentive to opt out is to pursue an individual case that could yield more money per hospital.

After subtracting legal fees and expenses, roughly $1.85 billion is left in the settlement fund to be payable to the claimants. Of the pot, 92% ($1.7 billion) is designated for hospitals and the remainder for individual providers and medical groups.

Payouts will be apportioned primarily based on each recipient’s amount billed to the Blues between 2008 and 2024, along with a coefficient that reflects the harm inflicted on reimbursement rates in the recipient’s geographic area.

On Sept. 23, plaintiffs’ attorneys said the settlement administrator has been authorized to proceed with assessing the million-plus claims in preparation for disbursing payments.

Finalized regulations look to phase out the manual aspect of prior authorization

Medicare’s FY26 final rule for hospital inpatient payments includes the latest federal effort to streamline and improve prior authorization.

The new regulations aim to standardize electronic prior authorization by incorporating HL7 Fast Healthcare Interoperability Resources technology. Starting in 2027, providers will be able to electronically obtain information on a health plan’s coverage requirements and input the necessary information in a workflow. They can submit the request and be kept apprised of its status directly through their electronic health record.