Democrats push for $1.4 trillion spending boost, risking federal shutdown

If the budget impasse is resolved quickly, the healthcare fight could resume later this fall as part of a long-term budget bill for the rest of the fiscal year.

The congressional showdown that could drive a federal government shutdown — scheduled for Oct. 1 — is driven by a Democratic push for a $1.4 trillion boost in federal spending.

Although a tiny share ($9 billion) of the funding increase sought by Democrats is non-healthcare, the main components of their budget bill are:

- $383 billion to extend for 10 years COVID-era subsidies for ACA marketplace plans

- Nearly $1.1 trillion to reverse recently enacted federal healthcare cuts

Congressional Democrats demanded the additional funding to provide the Senate votes needed to pass a continuing resolution (CR) that would otherwise provide level funding for the federal government through Oct. 31. Congressional leaders had planned to use the period after the CR to negotiate funding bills that would span the remainder of the fiscal year, which ends Sept. 30, 2026.

The House passed on Sept. 19 a “clean” continuing resolution, with level funding overall and without the additional healthcare funds, to keep the government running through Nov. 21. However, the Senate failed to pass that CR after Democrats uniformly opposed it. Senate passage would require eight Democratic votes to pass the measure since one Republican, Sen. Rand Paul (Kentucky), said he would oppose it because it did not cut spending.

Shutdown outlook

Some healthcare leaders said they were optimistic President Donald Trump would accede to Democrats’ demands for at least a renewal of the ACA marketplace subsidies because a federal shutdown would hurt Republican’s chances in 2026 mid-term elections.

But the Trump administration has demonstrated little fear of a political impact from a shutdown and even released plans to use a shutdown as a way to cull federal employees and programs it dislikes. Usually, non-essential federal workers are furloughed during a shutdown and afterward restart with back pay. Instead, an Office of Management and Budget memo released to Politico identified plans to implement a reduction in force (RIF) to fire employees from programs that would no longer have a funding source.

Such a move has drawn some public support, as a Reuters/Ipsos poll showed Americans are broadly supportive of cutting the bureaucracy. In an April poll, 55% of respondents — including almost all Republicans and one in four Democrats, said they supported downsizing the federal government’s 2.4 million federal civilian workforce.

It was not specified which federal workers or programs would be targeted. Some published report said programs mainly supported by Democrats would likely be targeted.

An HHS plan released Sept. 29 said 32,460 of its total 79,717 employees will be furloughed. At CMS, 3,105, or 50%, of staff will continue to work. A shutdown would not affect overall Medicare and Medicaid claims processing but some programs, like telehealth waivers would be affected. Further details on affected CMS programs are here.

HHS has already shed about 20,000 employees since the start of the current Trump administration. The Trump administration also has cut various HHS programs, including $12 billion in CDC grants for state substance use and infectious disease programs and $4 billion in National Institutes of Health (NIH) and National Science Foundation grants.

A similar RIF memo was released shortly before the deadline for a March 14 shutdown related to the last temporary funding measure Congress approved. Senate Democrats subsequently agreed to pass that measure.

Hospital impact

The healthcare provisions at the center of the CR fight could have major ramifications for hospitals.

The $1.1 trillion element would reverse most healthcare provisions enacted in July as part of the One Big Beautiful Bill Act (OBBBA). That law will reduce federal healthcare spending — mostly in Medicaid — over the coming 10 years by about that amount.

However, only some of those OBBBA cuts, which are related to ACA marketplace eligibility, would go into effect next year. For instance, the Democratic proposal would roll back OBBBA provisions going into effect in 2026 that limit subsidies during special enrollment periods (800,000 affected) and require more repayment of excess subsidies (100,000 affected), according to a Congressional Budget Office (CBO) estimate.

A bigger short-term impact would come from the $383 billion provision to extend ACA marketplace subsidies, which are set to expire at the end of this year. Extending the subsidies would increase the number with insurance by 3.6 million by 2030, according to a CBO estimate. Not renewing those subsidies would cause 2.2 million to lose insurance in 2026, according to a previous CBO estimate.

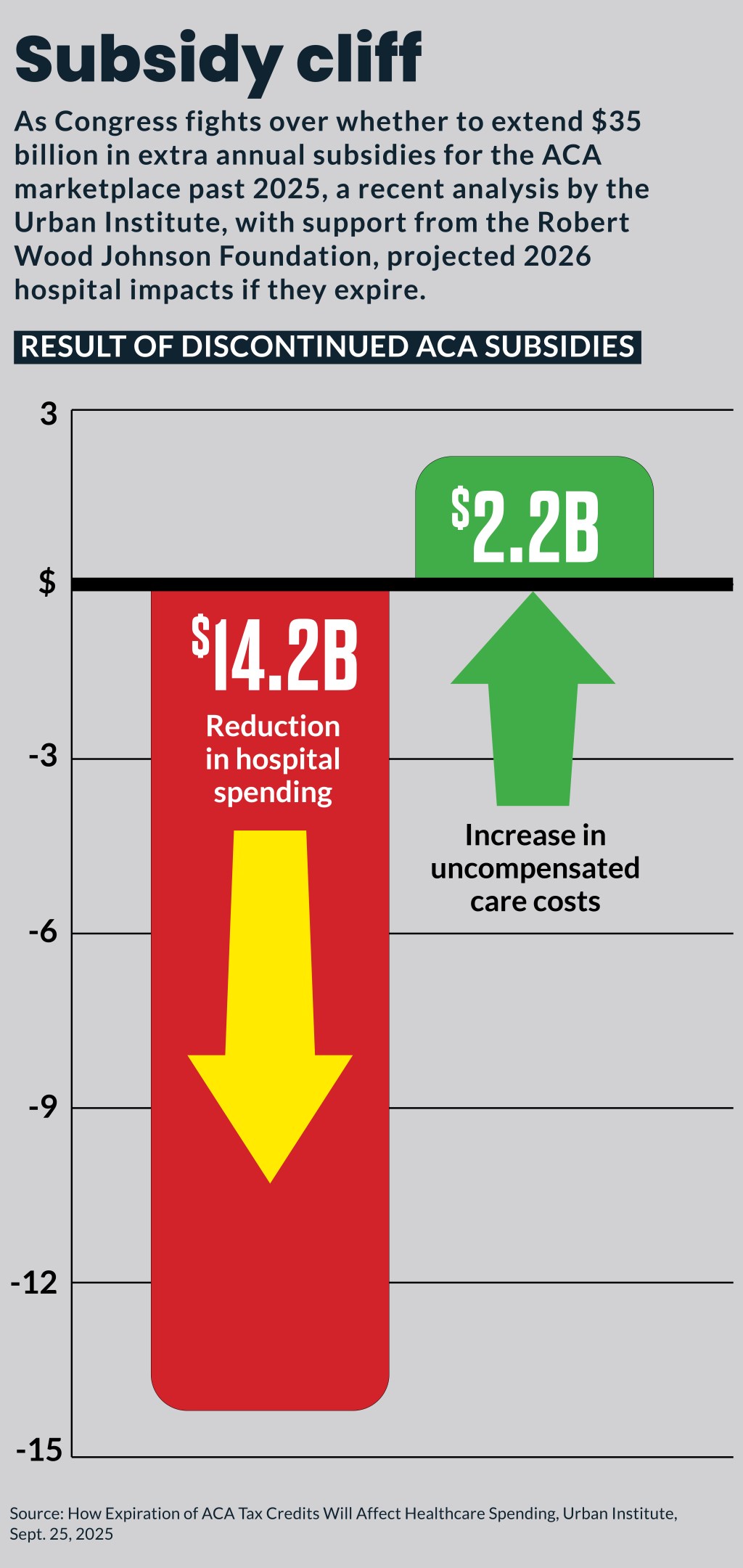

The coverage losses would result in a reduction in hospital spending in 2026 of $14.2 billion, according to a recent analysis by the Urban Institute, with support from the Robert Wood Johnson Foundation. All provider types would see a $32.1 billion reduction in spending next year, according to the analysis.

It also projected for 2026 a $7.7 billion increase in uncompensated care across all care sites and services, including about $2.2 billion in uncompensated care costs for hospitals.

National hospital groups said they have not taken a position on either the Republican or Democrat funding measures. However, they have urged continuation of the COVID-era ACA marketplace subsidies, as well as healthcare provisions traditionally funded in annual budget bills, including:

- Enhanced Medicare low-volume payment adjustments

- Medicare-dependent hospital program

- Telehealth flexibilities

- Hospital-at-home waiver

- GME funding

- Delay for $8 billion in Medicaid cuts to disproportionate share hospitals