Employers seek strategies to control surging hospital costs

Improved hospital revenue cycle capabilities were among the factors payers see as driving their cost increases.

Amid projections for a 2026 surge in health costs, some employers are increasingly looking at strategies to control hospital costs, as well as pushing federal policy changes for them.

Multiple employer surveys in recent weeks have projected 2026 cost increases for businesses approaching 10% in 2026.

In response, businesses — especially large employers — say they are undertaking more initiatives aimed at controlling hospital costs.

“Hospital costs have always been a perennial concern, but what we’re seeing now is an intensification of that pressure,” said Derek Skoog, FSA, MAAA, health actuarial and economics practice leader for PwC.

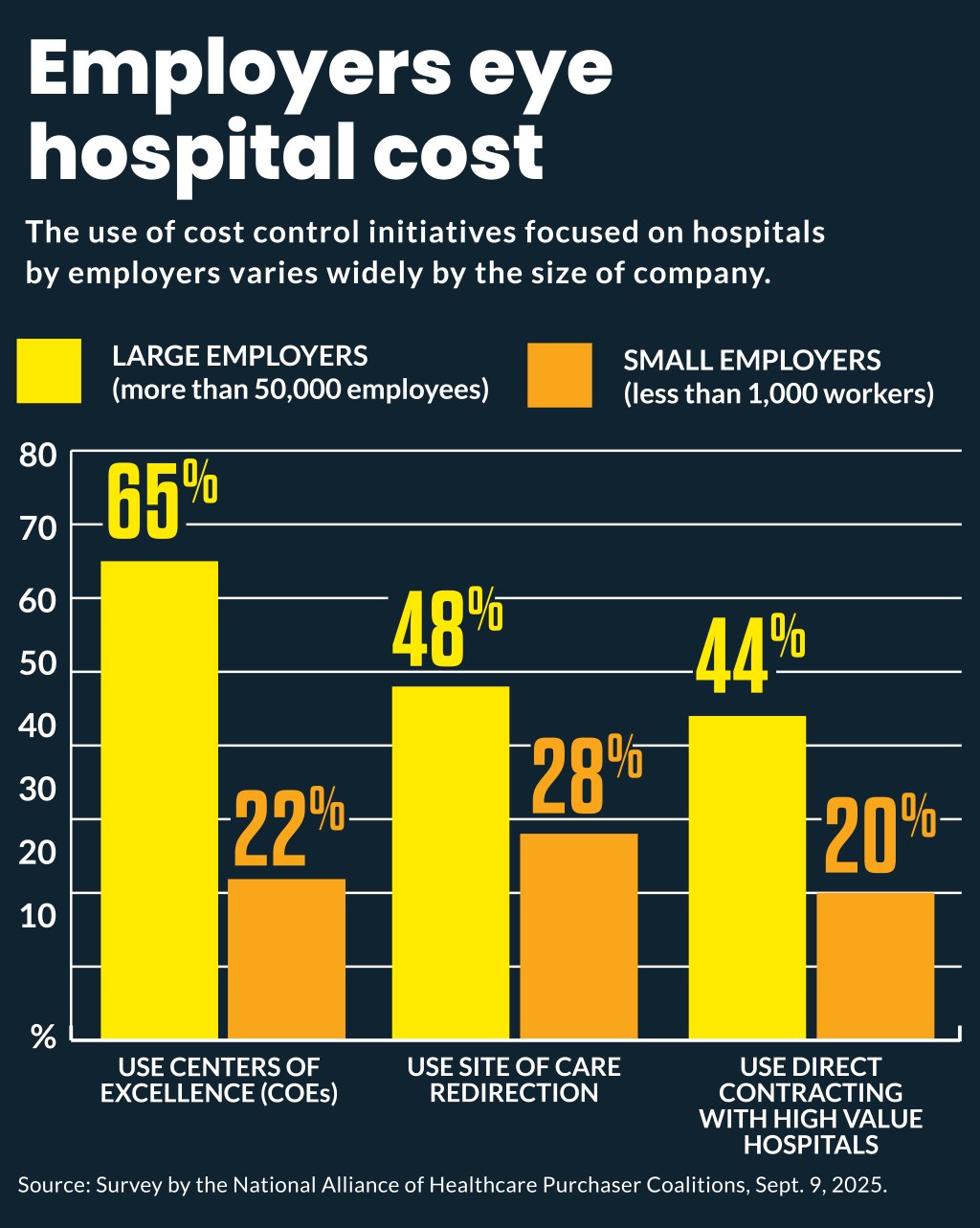

The share of large employers (more than 50,000 employees) undertaking initiatives on hospital costs, according to a recent National Alliance of Healthcare Purchaser Coalitions survey (free login required), include

- 65% use centers of excellence (COEs)

- 48% use site of care redirection

- 44% use direct contracting with high value hospitals

In comparison, use of those initiatives by employers with less than 1,000 workers include:

- 22% use COEs

- 28% use site of care redirections

- 20% use direct contracting

Use of those cost-control strategies was especially prevalent among those employers with complete claims access. For instance, businesses with access reported higher adoption of direct contracting (39% vs 15%).

Companies also are increasingly likely to prioritize shrinking the 340B Drug Pricing Program (25% vs. 5% in 2024), according to the Alliance survey.

The Alliance pushed 340B reforms earlier this year after its analysis found the program “is contributing to higher costs for commercial employers and their workers, rather than offsetting the cost of care.”

Similarly, the Purchaser Business Group on Health has been pushing increased enforcement by the Trump administration on hospital price transparency as a way to lower employers’ healthcare costs.

Why hospitals are blamed

Employers and payer advisers are citing changes hospitals have undertaken for their increasing concern about their role in driving employer-sponsored insurance costs.

For instance, Aon’s recent survey projected a 9.5% increase in employer healthcare costs in 2026. Among other factors, it said “hospital workforce expansion is enabling greater patient throughput, further contributing to higher levels of health care utilization.”

PwC’s annual survey of health plan actuaries projected 2026 medical cost trends to increase 8.5% for the group market and 7.5% for the individual market.

Hospital and health system developments that led PwC in a recent analysis to list those providers mentioned above as one of three inflators of payer costs include:

- Increasing wages faster than the national average

- Rising utilization

- Optimizing their revenue cycle processes

Seventy-three percent of health plan executives cited provider inflation and consolidation as top drivers of rising claims costs.

“What distinguishes today’s environment is the sustained inflation in labor, supplies and overhead, coupled with providers seeking higher commercial rates to offset stagnant or declining Medicare and Medicaid reimbursement,” said Skoog. “Additionally, hospital improvements in their revenue cycle management processes have created additional cost pressure. This dynamic makes hospital costs not just a persistent issue but a more acute driver of the overall medical trend.”

PwC’s recommended payers’ responses include:

- Implementing strong utilization management and payment integrity programs

- Shifting costs to providers through value-based contracts and alternative payment models

- Using data-driven analytics — like claims analysis, rate benchmarking and impact modeling of rate changes — in rate negotiations

Some employer groups have pushed businesses to control costs through an alternative arrangement like direct contracting. Skoog said direct contracting has not disappeared, “but it has not achieved the momentum many anticipated.”

“Financial outcomes from some high-profile arrangements have dampened enthusiasm, particularly as hospitals face margin pressures that make it difficult for them to lock in favorable terms,” he said. “Instead, we’re seeing more emphasis on alternative structures — such as employers leveraging centers of excellence, value-based care partnerships and Individual Coverage HRAs [Health Reimbursement Arrangements] (ICHRAs) — to manage costs.”

Multi-year trend

HUB International’s 2026 Trend study also found healthcare costs are accelerating, with 2026 trends projected at 8% to 10% for combined medical and prescription drug coverage.

The 2026 trend is part of a multi-year surge in similar healthcare cost increases since 2024, said Kirsten Bot, ASA, FCA, MAAA, national director of actuarial services and financial consulting for HUB.

The results came from combined actuarial projections from 26 health insurance companies.

The drivers were led by high-cost prescription claims but other healthcare costs and utilization also was increasing, she said.

“You’re seeing the pharmacy trend is higher than medical but, of course, medial claims are a higher proportion of the overall costs,” Bot said. “So, even though pharmacy is higher, it is not as large of a proportion of the overall claims that our clients are incurring.”

Future trend

Meanwhile, some industry advisers worry that hospitals will be forced to push much greater costs to employer plans in the coming years, to offset an estimated $1 trillion in reduced Medicaid spending under the recently enacted budget reconciliation law.

“Employer-based insurance really worries me because of the amount of cost shifting that’s [going to] happen with 15 or 20 million more uninsured people,” Jeff Goldsmith, PhD, president of Health Futures, Inc., said in a recent podcast. “There’s going to be huge increases in insurance premiums that are going to end up being blamed — not on this Congress — but on providers.”

In response, he urged hospitals to push broadly for local taxes to replace revenue from state-directed payments, which the law will reduce.

“Under the present system, employers are going to pay for it, and I don’t think that’s viable long term,” he said.