Unpaid medical bills rise as patients pay less out-of-pocket

Commercially insured patients are paying a declining share of out-of-pocket costs since the pandemic.

Patients have steadily reduced the amount of out-pocket costs they pay to health systems in recent years, according to new research.

The mean repayment rate for privately insured patients decreased from 54% in pre-pandemic years to 46% by 2023, according to a study in JAMA Health Forum.

The findings — based on a data from revenue cycle firm, FinThrive — echoed multiple previous reports from other revenue cycle companies. However, the new research was unusual in trending the data over multiple years. “In some settings, it does seem like unpaid bills make up a non-trivial portion of expense, so it’s easy to understand why some providers are frustrated by this issue,” said Benedic Ippolito, PhD, a senior fellow at the American Enterprise Institute, and one of the authors. The other authors were from the University of Southern California and Harvard.

Across all years studied, the mean unpaid commercial patient liability share of the health system’s total expected payment for services varied by setting, including:

- 4% for inpatient episodes

- 7.2% for outpatient episodes

The trend identified in the study echoed recent findings that uncompensated care costs sharply accelerated in recent years. However, that data indicated uncompensated care increases were mostly offset by increasing hospital incomes.

The recent study also found that overwhelming shares (92%) of commercially insured patients either paid all or none of their bill. The increase in unpaid bills over the years examined was driven by more patients paying nothing, rather than patients paying a smaller portion of the amount owed on their bill.

“It’s really interesting to me that this is an all of nothing issue; you either pay a bill or don’t pay a bill,” said Ippolito. “It doesn’t actually vary all that much based on the bill size; it varies somewhat.”

Drilling down

The study examined data from 217 hospitals from 2018 to 2024, which included 24.5 million commercial patient episodes of care where they had out-of-pocket costs.

It aimed to control for common billing delays by tracking repayment over a 12-month period after treatment. The mean commercial patient one-year repayment rate fell from 52% in 2021 to 47% in 2023.

The study’s hospital sample was more likely than hospitals nationally to be urban, less likely to be teaching hospitals and more likely to have a larger bed count.

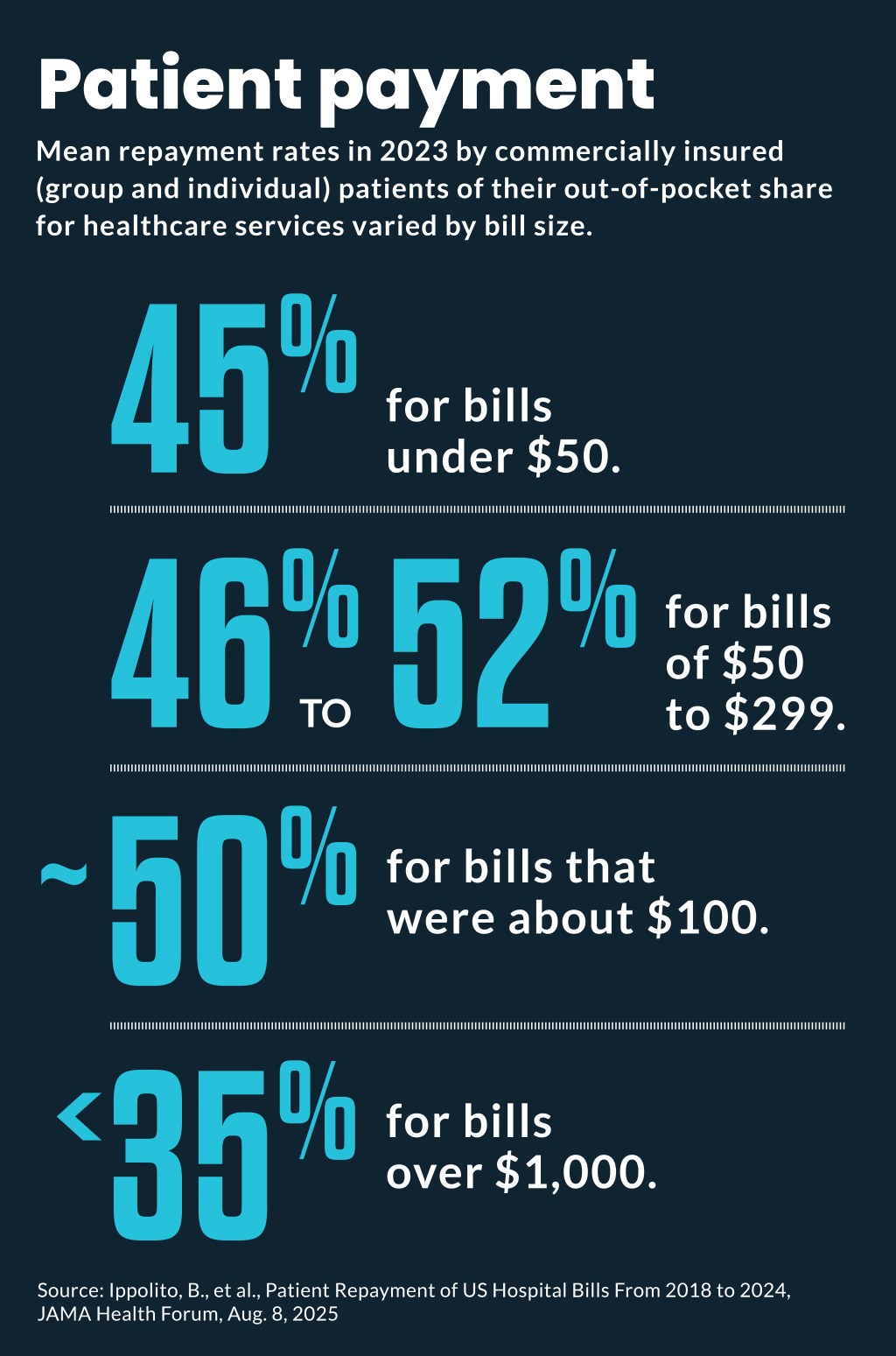

Mean repayment rates also varied by bill size, including:

- 45% for bills under $50

- 46% to 52% for bills of $50 to $299

- About 50% for bills that were approximately $100

- Less than 35% for bills more than $1,000

Other variations in repayment included patient age. Adults in their twenties had the lowest repayment rate, while older patients had the highest repayment rates.

Future trend

It’s unclear if the recent decrease in patient repayments will continue or reverse, Ippolito said, because the cause of the decrease is unclear.

Possible drivers of the trend include increases in high-deductible health plans (HDHPs) and reductions in debt reporting through industry initiatives and regulators.

A federal judge recently rolled back a federal ban on medical debt reporting on consumer credit reports. However, major credit reporting agencies in 2023 voluntarily agreed to remove paid medical debts and debts under $500 from credit reports.

Ippolito said it was not clear the HDHPs were a primary driver of the worsening trend because repayment rates were similar in January each year as they were in December — when many patients have met their deductibles.

It’s also possible that patients are under increasing financial strain after the 2022 and 2023 historic surges in inflation, which would leave small shares of income available to cover out-of-pocket costs.

“Maybe there’s a trough here and as inflation stabilizes and incomes and purchasing power stabilizes, maybe this plateaus and reverses,” Ippolito said. “That’s totally plausible.”

MA effect

A similar decrease in out-of-pocket payments was seen in the study years of 2018 to 2024 from Medicare Advantage (MA) patients. The mean repayment rate for MA patients’ out-of-pocket costs decreased from 55% in pre-pandemic years to 46% by 2023.

Similarly, the one-year repayment rate for MA patients decreased from 55% in 2021 to 50% in 2023.

Ninety-four percent of MA patients similarly either paid all or none of their out-of-pocket costs.

However, MA patients’ out-of-pocket costs were generally lower than those with commercial insurance, so the financial effect of decreasing repayment was lower. Over all years studied, the mean for those unpaid shares included:

- 2.6% of total expected payment for inpatient episodes

- 4.3% of total expected payments for outpatient episodes