Why it’s important to understand friction around claims denials

The rate of claims denials is increasing — and with it comes increased frustration between healthcare payers and providers. Here’s what to know.

Payment for healthcare services starts with a claim that details what type of care the patient received, why and the amount charged by a hospital or provider for these services. From there, the claim is typically sent to the patient’s health plan for reimbursement.

But the path to reimbursement for healthcare claims has become much harder for healthcare providers to navigate. That’s due in large part to increased use of AI by health plans to deny claims.

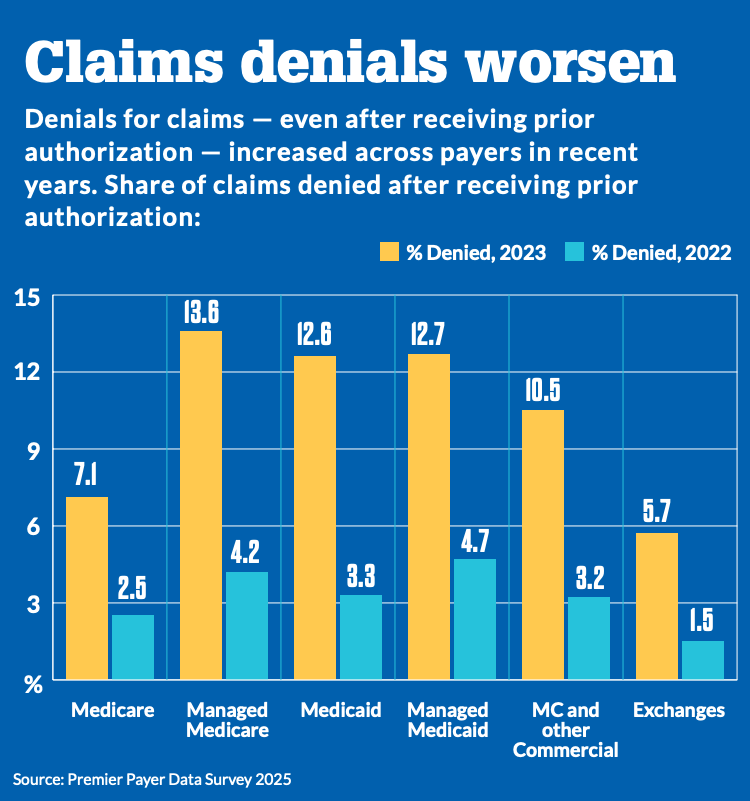

Claim denials are increasing

According to recent data:

- Initial Claim Denials are claims that are denied on first pass, forcing providers to resubmit. Rates have climbed to nearly 12% in 2024. That’s an increase of 2.4% year over year, according to Kodiak Solutions data.

- Nearly two-thirds of healthcare organizations plan to increase spending on AI through 2026. Over 40% say AI solutions for revenue cycle management are a top focus, a recent survey found.

- The rate of denials has increased even as providers have reduced prior authorization denials by 7.7%.

Impacts of denials for healthcare organizations

When this happens, it significantly disrupts cash flow in healthcare organizations. It also causes payment confusion for consumers.

“Payers appear to be using initial denials to slow payments, even though they ultimately pay approximately 90% of claims, a trend we have been tracking,” Matt Szaflarski, Kodiak’s vice president, revenue cycle intelligence, said in a release. “Even if the claims are ultimately paid, initial denials still cost hospitals, health systems and medical providers a lot of resources to overturn, and they also slow cash flow.”

Claims denials don’t just affect healthcare providers. They also cause confusion for consumers, who aren’t sure how much they owe or whether the health plan will change its mind — and when.

As one healthcare revenue cycle expert told HFMA, “Having to call a patient to say, ‘I’m so sorry, but we don’t have your authorization here from your insurance company, so we have to reschedule your procedure, and I apologize that you’ve already taken PTO and arranged transportation.’ That becomes a patient dissatisfier. They’re not upset with their payer when that happens. They’re upset with the provider.”

How healthcare providers are addressing denials

Leading health systems are going on offense against denials by:

- Process Automation and Machine Learning – Incorporating robotic process automation and machine learning to help ensure claims are as clean as possible and for work queue management

- AI Solutions – Leveraging AI-powered “bots” to check on claim status and prior authorization status to avoid initial denials and respond to denials more quickly

- Payer Liaison Teams – Creating payer liaison teams to work directly with health plans in addressing recurring issues with denials

- AI-Powered Denials Management – Adding generative AI for predictive denials management and proactive appeals

Denials management resources

Find out more

HFMA has conducted research around increasing claims denials and their impact. For more information about rising rates of denials and how healthcare organizations are responding, check out these resources:

Expand Your Knowledge with E-Learning

Stay ahead of industry trends with HFMA’s extensive e-learning courses and webinars.

Denials Management Forum

Share and learn about strategies to improve claim integrity, reduce denials, streamline administration, boost automation, enhance patient experience, and track performance with metrics.

Revenue Cycle Jobs

Find your next opportunity in revenue cycle or healthcare finance.

Discover Trusted Solutions

Elevate your results with products and services recognized by HFMA’s Peer Review program. Explore vetted solutions, each evaluated for quality, technical support, customer service, and value, across these key revenue cycle categories: Billing Compliance/Fraud & Abuse, Coding, Collection & A/R Debt Recovery, Denial Management/Third Party Recovery, Early Out/Self Pay, Patient Access/Eligibility, Patient Accounting/Revenue Cycle Systems, Patient Financial Experience, Patient Financing, and Revenue Cycle Outsourcing.