New data points to financial upsides in rethinking patient payment plans

More than one out of four workers covered by employer-sponsored health plans are on a high-deductible plan, which carry an average aggregate deductible of $5,343 for family coverage.[1] [2] As more of the financial burden of care shifts to patients, hospitals must consider: How effective is our approach to patient payment?

A recent survey conducted by HFMA and sponsored by PayZen indicates the extent to which providers struggle to capture out-of-pocket costs — the amount patients owe after insurance has covered its portion — from patients. It also reveals how hospitals are seeking to stabilize revenue streams by reducing days in accounts receivable (A/R), what’s working and what isn’t.

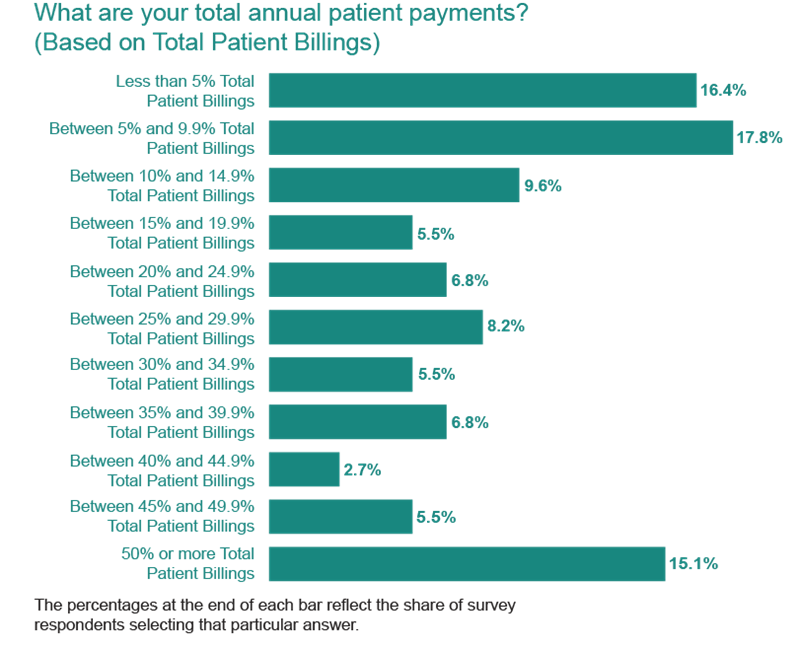

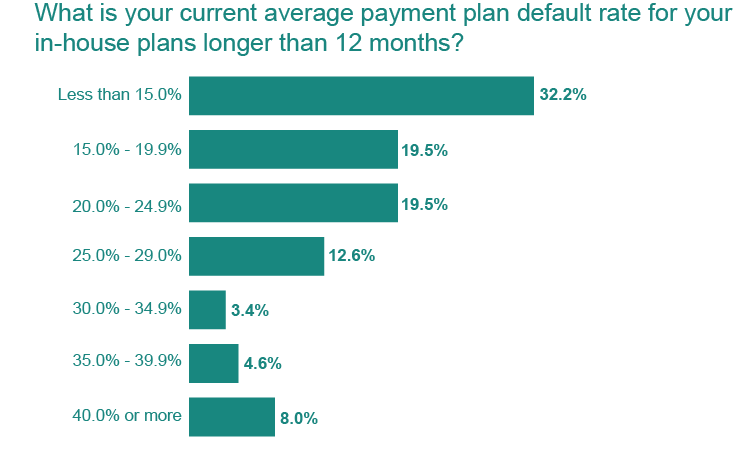

Today, providers collect just 24% of patient billings, or the amount owed after insurance, the survey of more than 200 healthcare finance professionals shows. (See the exhibit below.) And while patient payment plans — in-house or outsourced — are one way to help patients manage their out-of-pocket expenses while helping hospitals maintain financial viability, default rates on in-house plans with terms longer than 12 months are higher than 20%.

It is rare that hospitals don’t offer a payment plan; based on survey responses, just 7% of providers do not offer payment plans. Among hospitals that run payment plans with in-house staff support:

- 28% cap the length of these plans at 12 months or less

- 58% offer in-house plans with maximum terms of 24 months

- Nearly two out of three providers (62%) do not work with third-party financing partners to offer extended-term payment plans

Average collection rate for patient out-of pocket billings totals 24%

But the pressures of managing these plans in-house are growing, especially as the number of patients who struggle to pay their out-of-pocket costs rises. The average hospital or health system has outstanding payment plan balances that are twice as high as their annual payment plan collections. This ties up hospital capital. It also leads to high default rates for longer-term plans.

At a time when strengthening collection of patient balances is a top priority for 43.7% of healthcare finance professionals and the top priority for about one out of 10 respondents (11.4%), one revenue cycle expert fears hospitals are unintentionally pushing more patients into collections by failing to provide more flexible options for payments.

“Most hospitals and health systems do not leverage third-party financing partners or offer extended payment terms. Scenarios like these lead to avoidable bad debt and lost revenue opportunities,” said Tobias Mezger, chief revenue officer, PayZen, a patient financing company. “The truth is, most organizations don’t understand the complexity, staff time and resources involved in managing a payment plan long term. When their teams struggle to oversee an in-house, long-term payment plan, this increases financial strain on patients and the organization. It also potentially threatens the quality of the patient experience.”

Taking a Fresh Look at Patient Payment

The survey data offers a chance to evaluate how to strengthen the patient payment experience, including as it relates to payment plan offerings, terms and plan management.

“There isn’t a lot of data related to payment plan availability and factors for success within the healthcare finance space,” Mezger said.

“What surprised me in looking at the survey data is the amount of disparity that exists in payment plan options and how these plans are managed, and that disparity exists even when you separate the respondents by patient demographic, geography, type of organization or size of the organization,” Mezger said. “This tells me there is a lot of opportunity in this space for sharing of best practices.

High default rates on in-house payment plans reflect shortcomings, despite hospitals’ best efforts

“For example, in our experience, if you’re more flexible in the payment options you extend to payments, you will collect more on those payment plans over time. Likewise, if you tie in payment options to the pre-service process, when you’re providing estimates for out-of-pocket expense and requesting a payment, you will collect more on the pre-service side, overall.”

Given the complexity of managing patient payment plans in-house, one area hospitals may wish to explore to improve both revenue and the patient experience is outsourcing payment plan management to an experienced vendor.

For one $1.3 billion Net Patient Revenue health system, in-house payment plans proved effective in managing small balances, but leaders found that their organization’s payment plan model lacked the ability to support patients with higher balances. That’s because these patients typically need greater flexibility in terms — such as the ability to adjust the monthly payment amount when financial circumstances change — and longer terms for repayment.

Additionally, while the health system implemented a pre-service payment policy in the wake of the pandemic to combat rising self-pay balances and bad debt, a key challenge remained: Many patients urgently needed procedures but were unable to pay the required pre-service amount before receiving care.

The system looked for a partner whose services could complement its in-house payment plans while strengthening pre-service and post-service collections. With the vendor’s help, the health system adopted an approach that incorporated patient financing with a zero-percent interest rate at the point of service. This ensured affordability for patients while strengthening its pre-service collections. The health system also added affordable post-care payment plans — interest-free plans customized to the patient’s financial circumstances and informed by the patient’s financial behavior and payment history — to complement its own in-house finance offering.

The solutions integrated seamlessly with the health system’s Epic workflows — and the results were immediate. Over two years and across 22,000 payment plans, the health system increased self-pay collections 25%, saw a 37% jump in pre-service collections, achieved an 183% increase in payment plan participation and grew participation in its in-house, short-duration payment plans by 14%. The new model increased cash flow while also elevating patient satisfaction.

Doubling Down on Pre-Service Collections

Data from the HFMA survey also points to the value of assessing performance around patient estimates and pre-service collections.

On average, 16% of patient self-pay responsibility collections across all surveyed healthcare organizations occur at the pre-service stage, survey data shows.

Just one out of four hospitals conduct presumptive eligibility checks prior to service, a move that could quickly point to patients who qualify for government programs, financial assistance or charity care as well as those who may benefit from a payment plan.

“This is a missed opportunity to provide the appropriate financial care from the start of the encounter,” Mezger said.

Hospitals’ approach to pre-service estimates and collections varies significantly:

- Pre-service estimates are most often delivered by phone call (73%), followed by the patient portal (52%), email (45%), direct message (30%) or text (12%).

- When estimates are combined with a request for pre-service payment, 53.4% encourage payment but don’t require it. Another 22.8% require payment or a payment method on file.

- Among those that require pre-payment, 58.3% do not proceed with services unless a minimum amount is paid.

“Expectations around pre-service payment and the way in which these expectations are conveyed to patients matter,” Mezger said. “When delivering cost estimates, survey results show that hospitals that encourage or require pre-service payment see a 21% lift in pre-service collections and 20% higher overall collection rates.”

In his experience, success in pre-service collections depends on policies that are complemented by patient-friendly financing solutions. The best solutions provide flexibility and affordability to maximize financial performance without compromising patient access to care.

Developing the Right Approach

Whether managing payment plans in-house or through a partner, hospitals have an opportunity to improve collections, reduce bad debt and support a more affordable patient experience. Based on survey findings and real-world examples, four elements stand out:

- Ask early and offer payment options. Hospitals that deliver estimates and encourage or require pre-service payment see significantly higher pre-service and overall collection rates.

- Provide flexibility for those who need it. Extended terms and interest-free plans improve affordability for patients, leading to higher plan participation and repayment over time.

- Understand the full cost of in-house plans. Tracking default rates, staff time and capital costs helps hospitals assess the true performance of internal programs.

- Evaluate the impact on cash flow. Understanding how much capital is tied up in payment plans — and how that affects days in accounts receivable and liquidity — is crucial to strengthening financial performance.

“Too often, the conversation around financing gets reduced to recourse versus non-recourse,” said Mezger. “But that misses the bigger picture. The real question is: Are you able to engage patients who might otherwise end up in bad debt and, whether internal or external, improve the economics of payment plans through better technology, data and design?”

About PayZen

PayZen is a mission-driven healthcare fintech company with smart technology and a patient-first mindset. Rated the top Patient Financing Company by KLAS, PayZen is expanding beyond financing and building a comprehensive AI platform that brings financial health to healthcare. The company is backed by premier capital partners and led by tech veterans with a track record of helping millions of Americans overcome financial struggles. To learn more about how PayZen is helping health systems strengthen financial performance while delivering an empathetic, high-quality patient experience, visit payzen.com.

This published piece is provided solely for informational purposes. HFMA does not endorse the published material or warrant or guarantee its accuracy. The statements and opinions by participants are those of the participants and not those of HFMA. References to commercial manufacturers, vendors, products, or services that may appear do not constitute endorsements by HFMA.

Footnotes

[1]. “2024 Employer health benefits survey,” Kaiser Family Foundation, Oct. 9, 2024.

[2]. Ibid.